Battles

Get Ur Rest

Look for Joy

We have

A Big Fight

Ahead

have time to

to send some

money DU`s

way. Support

the summer

fund drive!

I have

DU friends

everywhere.

Rebellions

are built

on HOPE

DU

keeps

HOPE

alive

Thank you

EarlG

all the stickies

on Grovelbot's

Big Board!

Inflation picks up again in June, rising at 2.7% annual rate

Source: CNBC

Published Tue, Jul 15 2025 8:31 AM EDT Updated 11 Min Ago

Consumer prices rose in June as President Donald Trump’s tariffs began to slowly work their way through the U.S. economy.

The consumer price index, a broad-based measure of goods and services costs, increased 0.3% on the month, putting the 12-month inflation rate at 2.7%, the Bureau of Labor Statistics reported Tuesday. The numbers were right in line with the Dow Jones consensus.

Excluding volatile food and energy prices, core inflation picked up 0.2% on the month, with the annual rate moving to 2.9%, with the annual rate in line with estimates. The monthly level was slightly below the outlook for a 0.3% gain.

Prior to June, inflation had been on a generally downward slope for the year, with headline CPI at a 3% annual rate back in January and progressing gradually slower in the subsequent months despite fears that Trump’s trade war would drive prices higher.

Read more: https://www.cnbc.com/2025/07/15/cpi-inflation-report-june-2025.html

From the source -

Link to tweet

@BLS_gov

·

Follow

CPI for all items rises 0.3% in June; shelter up #BLSData #CPI https://bls.gov/news.release/archives/cpi_071502025.htm

8:30 AM · Jul 15, 2025

Article updated.

Previous articles -

Published Tue, Jul 15 2025 8:31 AM EDT Updated 11 Min Ago

Consumer prices rose in June as President Donald Trump's tariffs began to slowly work their way through the U.S. economy.

The consumer price index, a broad-based measure of goods and services costs, increased 0.3% on the month, putting the 12-month inflation rate at 2.7%, the Bureau of Labor Statistics reported Tuesday. The numbers were right in line with the Dow Jones consensus.

Excluding volatile food and energy prices, core inflation picked up 0.2% on the month, with the annual rate moving to 2.9%, also matching the respective estimates.

Prior to June, inflation had been on a generally downward slope for the year, with headline CPI at a 3% annual rate back in January and progressing gradually slower in the subsequent months despite fears that Trump's trade war would drive prices higher. While the evidence in June was mixed on how much influence tariffs had over prices, there were signs that the duties are having an impact.

Consumer prices rose in June as President Donald Trump's tariffs began to slowly work their way through the U.S. economy.

The consumer price index, a broad-based measure of goods and services costs, increased 0.3% on the month, putting the 12-month inflation rate at 2.7%, the Bureau of Labor Statistics reported Tuesday. The numbers were right in line with the Dow Jones consensus.

Excluding volatile food and energy prices, core inflation picked up 0.2% on the month, with the annual rate moving to 2.9%, also matching the respective estimates.

This is breaking news. Please refresh for updates.

Original article -

The consumer price index in June was expected to increase 2.7% from a year ago, according to the Dow Jones consensus estimate.

This is breaking news. Please refresh for updates.

OrlandoDem2

(3,075 posts)bucolic_frolic

(52,013 posts)This is inflation liftoff. Full throttle!

usregimechange

(18,567 posts)What are they saying this AM?

FredGarvin

(687 posts)Maybe Wall Street expected a higher number?

Hmmmm

Lower than expected inflation coupled with gains in 401K and IRA accounts is good news

BumRushDaShow

(158,623 posts)but what was generally expected - https://www.cnbc.com/2025/07/14/inflation-report-tuesday-should-give-clues-on-price-effect-from-tariffs.html

CPI, which measures a broad basket of goods and services across the U.S. economy, is expected to show a 0.3% monthly increase for both headline and core rates, with the latter excluding volatile food and energy costs. On an annual basis, the index is expected to show a 2.7% headline reading and 3% on core.

(snip)

Meaning that inflation overall was going to start to go up, not down and the estimates were spot on (except the Core CPI estimate was 0.1% off. I.e., 3.0% estimate vs 2.9% actual).

With the bunch of business apps that I have on my phone and iPad, they seem to be fixated on Nvidia and of course the whole AI thing (tech heavy focus) with respect to the markets - at least at the moment. The EU issue might factor in later though.

FredGarvin

(687 posts)I get a feeling that a rate cut is expected.

Which will accelerate inflation.

Which means more profits for corporations and higher RE prices

BumRushDaShow

(158,623 posts)But not the Dow, which dropped almost 150 points this morning and is slowly coming back - bopping around -80 to -90.

The S&P and NASDAQ are broader but also tech-focused. There were some earnings reports out like JP Morgan, with better than expected earnings but blabby Jamie Dimon doing his usual "warnings".

ETA - Dow now down ~160 points at edit time ~10:10 am EDT.

FredGarvin

(687 posts)The markets will explode higher when Trump takes over the Fed and lowers rates.

Just a matter of time

BumRushDaShow

(158,623 posts)is BECAUSE the "real market" capitalists - NOT the nouveau ones - have warned against that.

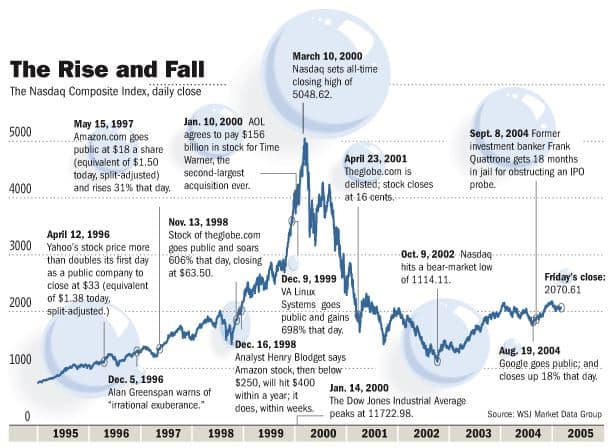

There is an "AI bubble" forming big time, not unlike what happened with the "dot-com bubble" that started some 30 years ago -

(above from here, which had a nice plot - https://www.modwm.com/dot-com-bubble-history-remains-relevant/)

(I forgot about "Aol-Time Warner" ![]() )

)

Bernardo de La Paz

(57,672 posts)The market is too focused on rate cuts. By time rate cuts arrive they might be happening because of a softening economy (employment side of the Fed mandate) and the market might realize that is not such a good thing.

The market wants rate cuts to boost investment and thereby profits, but investment was steady until tRump disrupted international trade. Now there is a lot of investment in "capex", capital expenditures, for AI "data centers" and some tentative onshoring in response to tariffs, but a lot of the big investments that tRump is bleeting about will be slow to occur because the trade and tariff environment is so uncertain right now. It's as if everyone, CEOs on down to berry pickers, is gripping the gunwales of the rowboat with a death grip and whispering "steady as she goes, don't rock the boat, keep your head down".

The job market is tight: unemployment claims are not moving much but that's not because of business expansion. It's because workers are sitting tight, not trying to find better positions and companies are not hiring much in the way of new hires. Government layoffs are cushioned by many choosing "deferred resignation" that kicks in September and later.

There is a lot of unemployment due to ICE raids, but those workers don't file unemployment claims, especially with Gnome and {in}Homan pawing through confidential government databases. All the same, the meat packer or construction worker not working is also not spending.

Bernardo de La Paz

(57,672 posts)Johnny2X2X

(23,223 posts)"No one ever thought that raising prices could raise prices." trump probably soon.

IronLionZion

(49,702 posts)oh wait... ![]()

![]()

It's almost as if tariffs and mass deportations are increasing prices. ![]()

progree

(12,240 posts)News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

The CPI rise averaged 2.4% over the past 3 months on an annualized basis (core CPI: 2.4%)

The June one month increase annualized is: CPI: 3.5%, (core CPI: 2.8%)

REGULAR CPI

CORE CPI

Both the CPI and Core CPI 3 month rolling average were helped a lot when the huge January increases dropped out of the 3-month window, and were hurt a lot when the March decrease for the CPI and the tiny increase for the Core CPI dropped out of the window.

The rolling 12 months averages graphs are in the OP. They were hurt by last year's very small June 2024 month-over-month increases dropping out of the 12 month window. What drops out of the window is just as important as what enters the 12 month window (which is the latest, June 2025).

Some featured items from the BLS news summary https://www.bls.gov/news.release/cpi.nr0.htm

Increases in June over May:

Shelter: +0.2%, Energy: +0.9%, Gasoline: +1.0%, Food and food at home: +0.3%, Food way from home: +0.4%,

12 month increases:

Energy: -0.8%, Food: +3.0%

Bar graph of increases and decreases of various CPI components arranged from highest increase to lowest and then decreases, 12 month numbers (year-over-year)

https://finance.yahoo.com/personal-finance/banking/article/june-inflation-breakdown-consumers-feel-the-pinch-with-tariffs-looming-181129115.html

Household energy +7.1%

Auto insurance: +6.1%

Housing: +4.0%

Restaurant meals: +3.8%

. . .

Hotel rooms: -2.5%

Electrionics: -3.3%

Airfare -3.5%

Gasoline: -8.3%