We\'re not

going back!

(=^.^=)

~~~~~~~~~~~~

FUCK

DONALD

TRUMP

(=^.^=)

~~~~~~~~

897932384626

433832795028

841971693993

751058209749

445923078164

062862089986

MONEY

DOES NOT

EQUAL

SPEECH

$ $ $

THE BEST

DEMOCRACY

MONEY CAN

BUY!!

*****

We\'re #1

Who knew?

So many

good Germans

in our party

:-(

all the stickies

on Grovelbot's

Big Board!

Consumer prices rise 2.7% annually in July, less than expected amid tariff worries

Source: CNBC

Published Tue, Aug 12 2025 8:31 AM EDT Updated 7 Min Ago

A widely followed measure of inflation accelerated slightly less than expected in July on an annual basis as President Donald Trump’s tariffs showed mostly modest impacts.

The consumer price index increased a seasonally adjusted 0.2% for the month and 2.7% on a 12-month basis, the Bureau of Labor Statistics reported Tuesday. That compared to the respective Dow Jones estimates for 0.2% and 2.8%.

Excluding food and energy, core CPI increased 0.3% for the month and 3.1% from a year ago, compared to the forecasts for 0.3% and 3%. Federal Reserve officials generally consider core inflation to be a better reading for longer-term trends.

A 0.2% increase in shelter costs drove much of the rise in the index, while food prices were flat and energy fell 1.1%, the BLS said. Tariff-sensitive New vehicle prices also were unchanged though used cars and trucks saw a 0.5% jump. Transportation and medical care services both posted 0.8% moves higher.

Read more: https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

From the source -

Link to tweet

@BLS_gov

·

Follow

CPI for all items rises 0.2% in July; shelter up https://bls.gov/news.release/cpi.nr0.htm

#CPI #BLSdata

8:31 AM · Aug 12, 2025

Article updated.

Previous article -

A widely followed measure of inflation accelerated slightly less than expected in July on an annual basis as President Donald Trump's tariffs worked their way through the economy.

The consumer price index increased a seasonally adjusted 0.2% for the month and 2.7% on a 12-month basis, the Bureau of Labor Statistics reported Tuesday. That compared to the respective Dow Jones estimates for 0.2% and 2.8%.

Excluding food and energy, core CPI increased 0.3% for the month and 3.1% from a year ago, compared to the forecasts for 0.3% and 3%. Federal Reserve officials generally consider core inflation to be a better reading for longer-term trends.

This is breaking news. Please refresh for updates.

Original article -

The consumer price index was projected to increase 0.2% in July and 2.8% for a year ago on headline, and 0.3% and 3% on core, according to the Dow Jones consensus estimate.

This is breaking news. Please refresh for updates.

underpants

(192,313 posts)BumRushDaShow

(158,597 posts)and getting further from the 2% "target". Have to see what the "core" is.

Mike 03

(18,683 posts)BumRushDaShow

(158,597 posts)I expect progree is working on his graphs right now (if he's up - it's an hour earlier where he is)! ![]()

Mike 03

(18,683 posts)It's an upward trend, with "services" even higher.

The guests on Bloomberg are wondering aloud how Powell can really cut rates in September with numbers like this. (Of course they are going through it item by item).

bucolic_frolic

(52,002 posts)we focus on imported tariffed items, but i do see some price drops on domestic food.

BumRushDaShow

(158,597 posts)I heard a report last night on the radio about how they are still trying to hold on from passing the costs on - basically eating about "2/3rds" of the tariffs. But there is an expectation that this will reverse come this fall where the consumer will get that "2/3rds" passed onto them (it may have been a Bloomberg business report aired on the radio).

There was a big stock up before the tariffs happened so some industries are able to run through their inventories without needing to raise prices.

Johnny2X2X

(23,223 posts)Highest rise in 6 months. Going up and not down. Core inflation up 3.1% vs 2.9% in June.

SunSeeker

(56,501 posts)The Rising Cost Of Groceries By State (2025)

https://www.consumeraffairs.com/finance/cost-of-groceries-by-state.html

Lovie777

(19,825 posts)the economy is not good. I'm living it, I'm feeling it.

Biophilic

(5,998 posts)The only thing NOT up were eggs.

SunSeeker

(56,501 posts)Yes, eggs have gone down from their bird flu peak, but still not cheap at $4-$5/dozen. Meanwhile, milk, bread, and especially meat, are WAY up. It's bad even at Costco.

Mike 03

(18,683 posts)smart economists disapproving and saying they gave into pressure, or acted prematurely.

One of the guests, though, on Bloomberg is making the argument that slower growth will offset ( "pull down" ) inflation, but she's saying nobody really wants slowed growth.

BumRushDaShow

(158,597 posts)before their next meeting so that will factor in as well.

progree

(12,240 posts)(Assuming tRump doesn't order an emergency rate-cutting meeting)

So, before the next meeting, there will be a new "First Friday" jobs report on September 5.

And a PPI report (wholesale prices) this Thursday

And a PCE inflation report near the very end of this month (Fed's favorite inflation gauge)

And another CPI report Sept 11, and probably another PPI report.

And there's JOLTS (Job Openings and Labor Turnover Survey) and weekly unemployment insurance claims reports

There's the monthly retail sales reports

Plenty of S&P and PMI manufacturing and service reports

Consumer Confidence and Consumer Sentiments Surveys, I mean Reports ![]()

BumRushDaShow

(158,597 posts)Was just looking at the Philly Fed calendar and the Manufacturing survey is due for release this Friday 8/15/25.

At some point, all of that funding from Biden's Infrastructure Act & Inflation Reduction Act, that has either been halted or completely cut, is going to get reflected in those reports.

Bluestocking

(245 posts)gab13by13

(29,456 posts)SunSeeker

(56,501 posts)I buy groceries twice a week. I know. Sure, eggs are down from their bird flu peak, but everything else is way up: coffee, bread, and especially meat.

cadoman

(1,617 posts)For grocery prices to go down we'd need to have significant deflation over multiple quarters, but our monetary system is actually designed to create inflation so that can be tricky.

We'd need an influx of affordable labor, zero tariffs, or a collapse of input costs to get some grocery price deflation. None of those seem to be on the table, especially with AI now guzzling up electricity and water everywhere.

We're in an awful situation now where AI, farming, and oil extraction all demand enormous quantities of freshwater.

The only thing I can see on the horizon where we might see some price relief is in housing. The prices are dramatically inflated, the inventory is centrally held by financiers, and the rates are high. Some citizen-friendly regulations could dislodge that inventory when Democrats return to power.

SunSeeker

(56,501 posts)Bernardo de La Paz

(57,668 posts)cadoman

(1,617 posts)"The Federal Open Market Committee (FOMC) judges that inflation of 2 percent over the longer run, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with the Federal Reserve’s mandate for maximum employment and price stability. When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy."

Canada's reserve bank has the same 2% target:

https://www.bankofcanada.ca/core-functions/monetary-policy/

"At the heart of Canada’s monetary policy framework is the inflation-control target, which is the 2% midpoint of the 1%–3% control range. First introduced in 1991, the target is set jointly by the Bank of Canada and the federal government and is reviewed every five years."

So 2% is what they are both shooting for.

Bernardo de La Paz

(57,668 posts)If there was zero price growth, there would be no economic growth. I was replying to a poster who implied that "rise" was no rise, i.e. steady.

You use "steady" and "stable" to refer to a steady rise and a stable rise which means a non-volatile rise, but it is still a rise.

It is very common for people to confuse a rate of change with the underlying statistic. The post I replied to was brief without nuance and specific without reference to a thing or two the poster was thinking but that we were not privy to.

SunSeeker

(56,501 posts)You and I know how inflation numbers work. Sadly, most Americans do not. Nor did many understand what a tariff is, although they're starting to figure it out at the checkout stand. Approximately 54% of US adults read below a sixth-grade level. Headlines should take all of that into consideration. The headline should have read, "Most prices continue to rise at the same rate, while some prices shoot up faster."

Republicans are great at communicating with the poorly educated. Their business allies teach them the tricks they have successfully used to get Americans to buy crap. It works at selling bad political ideas too.

Democrats, on the other hand, believe in truth and using educated explanations. So we tend to get stuck in these pedantic statements that most Americans don't understand. We need to learn to communicate the truth to 5th graders.

cadoman

(1,617 posts)And in fairness to CNBC, their demographic is financially literate folks who are watching the channel because they have some cash to invest and are looking for ideas & info related to that.

The headline is only confusing here because we're a more general forum. If it were NPR they would take 15 seconds to give the basics.

Bernardo de La Paz

(57,668 posts)Actually almost all of them are sophisticated enough to read simple wording and understand it. Making excuses for people missing the plain obvious meaning of words like the headline is not good social policy.

What I posted about was your take on it when you wrote "Yes, of course. But the headline implies prices stayed steady. nt" You did not refer to anybody. You stated the implication (meaning) of the words of the headline and it sure seemed like you were believing it meant prices stayed steady. You did not refer to communicating to the poorly educated.

The way to communicate to the poorly educated ... and we mean for Democrats to communicate and the journalists and editors of the news organizaton are not working in the role of Democrats; at least we hope the professionals are not slanting the news even to favour Democrats ... The way for Democrats to communicate is to use plain words plainly.

Here are some plain words:

The longest word has eight letters. The poorly educated understand the first three words very clearly. They've heard enough about inflation to know that 2.7% is not as bad as 8 or 9 percent, which they've heard about recently. They know what the plain meaning of "less than expected" is. It's not rocket surgery. They know tariffs are in the news even if they hear very little news and they know people are worried about it.

It must be a very low opinion of the poorly educated to hold that they can't understand the word "rising" (six letters) and that we should use even simpler words.

SunSeeker

(56,501 posts)progree

(12,240 posts)Last edited Tue Aug 12, 2025, 05:05 PM - Edit history (2)

News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

The CPI rise averaged 2.3% over the past 3 months on an annualized basis (core CPI: 2.8%)

The July one month increase annualized is: CPI: 2.4%, (core CPI: 3.9%)

REGULAR CPI

CORE CPI

Both the CPI and Core CPI 3 month rolling average were helped when the large April increases dropped out of the 3-month window

The Year - over - year CPI and Core CPI from the OP

So that all the graphs are together

The 12 months averages were hurt by last year's small July 2024 month-over-month increases dropping out of the 12 month window. What drops out of the window is just as important as what enters the 12 month window (which is the latest, July 2025).

Some featured items from the BLS news summary https://www.bls.gov/news.release/cpi.nr0.htm

Increases in July over June:

Shelter: +0.2%, Energy: -1.1%, Gasoline: -2.2%,

Food: 0.0% and food at home: -0.1%, (I know, I know), Food away from home: +0.3%,

12 month increases:

Energy: -1.6%, Food: +2.9%

BumRushDaShow

(158,597 posts)Thought about you when I saw the CNBC update showing the core!

ETA - I noticed the core on your chart starts suddenly ticking up after that "Liberation Day" nonsense was announced April 2nd.

SunSeeker

(56,501 posts)Unless they're just looking at eggs, this is totally wrong.

sinkingfeeling

(56,190 posts)SunSeeker

(56,501 posts)There must be a lag in reporting or something because groceries are way up, especially coffee, bread and meat.

BumRushDaShow

(158,597 posts)I expect the ridiculous price for beef might eventually show up (although I noticed other products like shrimp were down). The eggs have come down some but NOT to what they were a year ago before they shot up.

SunSeeker

(56,501 posts)Yahoo Finance had the most relevant headline.

CPI: Core inflation rises by most in six months, stoking tariff-driven price concerns

https://finance.yahoo.com/news/cpi-core-inflation-rises-by-most-in-six-months-stoking-tariff-driven-price-concerns-130820737.html

Even CNN had a better headline that CNBC.

Inflation holds steady, but Trump’s tariffs are boosting some prices

https://www.cnn.com/2025/08/12/economy/us-cpi-consumer-inflation-july

BumRushDaShow

(158,597 posts)In this case, they were focusing on the "headline" inflation figure versus the "core" (the latter being what the Fed looks at).

I have the CNBC, Yahoo! Finance, MarketWatch, and Bloomberg apps on my iPad for their breaking banners (as well as CNN, AP, The Guardian, and a bunch of others too), but usually CNBC or Yahoo! Finance are FIRST out of the gate after the government release, with an actual story before the others come straggling along. The others tend to start off as a "Live Updates" (which I can't use in LBN) before they finally compile that into a separate article with its own link.

JT45242

(3,578 posts)Bananas for one.

A lot of the other tariffs had not yet kicked in or been passed on with prices yet

cadoman

(1,617 posts)Very weird as I would have expected domestic berry/tomato to struggle with labor shortages.

Wonder if berry production just really ramped up the last five years or so. Seems like more people started buying them regularly.

twodogsbarking

(15,174 posts)Ritabert

(1,549 posts)...what with TACO delaying them at will. Instant coffee was up $4 a jar a couple of days ago over last week.

CNYHarris

(113 posts)Bernardo de La Paz

(57,668 posts)CNYHarris

(113 posts)Bush/Reagan did the same thing.

Bernardo de La Paz

(57,668 posts)CNYHarris

(113 posts)Reagan in the 1980s cooked the books by changing how GDP is calculated.

That is how you cook the books easily.

Bernardo de La Paz

(57,668 posts)You have no link, just an assertion that is meaningless.

It was economists, professionally, not Reagan. We used to talk about GNP a lot. Now we never do. Because economics advanced.

CNYHarris

(113 posts)CNYHarris

(113 posts)Except Democrats were ok with the Reagan changes. Because that meant patriotism.

Torchlight

(5,364 posts)Good luck.

Bernardo de La Paz

(57,668 posts)I have tried to find information about the actual changes to the calculation during the Reagan regime and can't find any. Apparently neither can you, because your link doesn't support your claim about that.

Further, when I search for "shadowstats accuracy bias" these are the links I get:

https://www.thestreet.com › economonitor › emerging-markets › deconstructing-shadowstats-why-is-it-so-loved-by-its-followers-but-scorned-by-economists

Deconstructing ShadowStats. Why is it so Loved by its Followers but ...

It is hard to think of a website so loved by its followers and so scorned by economists as John Williams' ShadowStats, a widely cited source of alternative economic data on inflation and other ...

https://econbrowser.com › archives › 2008 › 09 › shadowstats_deb

Shadowstats debunked | Econbrowser

Shadowstats debunked I've yet to find someone who has been able to reproduce the claims made by Shadow Government Statistics about the extent to which government agencies are grossly misreporting the U.S. inflation rate.

https://www.investing.com › analysis › deconstructing-and-debunking-shadowstats-249923

Deconstructing And Debunking Shadowstats - Investing.com

The ratio of the ShadowStats prediction to the actual price is 3.32, an overstatement of 223 percent. For tuna, both indexes overestimate inflation, the CPI by 34 percent and ShadowStats by 478 ...

https://www.fullstackeconomics.com › p › no-the-real-inflation-rate-isnt-14-percent

No, the real inflation rate isn't 15 percent - Full Stack Economics

According to Shadowstats, if you calculate the inflation rate using old methodology from the 1980s, the true inflation rate is 6 to 8 percentage points higher than the official statistics indicate—and has been for decades. This line of reasoning has become popular in some cryptocurrency circles.

https://www.brightworkresearch.com › how-accurate-is-shadowstats-on-the-understatement-of-us-inflation-with-the-new-cpi

How Accurate is ShadowStats on The Understatement of US Inflation With ...

Shadowstats is built on the belief that the Bureau of Labor Statistics changed their methodology in the 1980s and 1990s, and that if we were using their original methodology the level of inflation would be much higher. Shadowstats presents what they claim to be the original methodology. But Shadowstats is not calculating inflation any differently.

Response to Bernardo de La Paz (Reply #48)

Post removed

Bernardo de La Paz

(57,668 posts)Bernardo de La Paz

(57,668 posts)Wiz Imp

(6,647 posts)[All excerpts from Wikipedia]

That's this Paul Craig Roberts:

And this Wayne Allyn Root:

Senior Fellow of the Niskanen Center Ed Dolan has found these alternatives to be "implausibly high" in spite of potential errors in the official data, especially when cross checked with data on nominal interest rates and physical output. Shadowstats measure of inflation has also been unfavorably compared with alternative private measures such as the Billions Prices Project which tracks millions of online retail prices from around the world in real time. In addition, despite claims of much higher inflation than official reports suggest, and even potential hyperinflation in the future, Shadowstats has not changed its $175 per year subscription fee since at least 2006, leading some to humor its own claims.

Responding to prior criticisms made by economist James Hamilton, John Williams explained in a private phone call that Shadowstats does not actually recalculate BLS data, rather, the Shadowstats CPI merely adds a constant to the officially reported numbers.

I’m not going back and recalculating the CPI. All I’m doing is going back to the government’s estimates of what the effect would be and using that as an add factor to the reported statistics.

Wiz Imp

(6,647 posts)You really believe the unemployment rate was 25% in 2023? That is so far beyond reality it would be funny if the guy wasn't serious. Pure insanity.

CNYHarris

(113 posts)Last edited Tue Aug 12, 2025, 11:26 AM - Edit history (1)

I would guess that is adding those outside the labor market.

It shows millions left the labor market during the Bush recession and never return to get a job. Lived with parents or friends = unemployed.

Wiz Imp

(6,647 posts)It has zero basis in reality.

CNYHarris

(113 posts)Shadow Stats takes that into the tallies, government stats does not look at the entire unemployed number.

what I don't get is the site shows millions that got unemployed during the bush and trump years from their recessions never returned to work, it shows Republicans ruined America and use manipulated data to hide the sufferings of Americans. Democrats should at least be curious to do things the old ways that does not cook the books.

AI is the last thing we have online for finding the hidden truth that have been removed from the search results.

AI:

Yes, the U.S. unemployment rate (officially known as U-3) does not count people who have left the labor market and stopped looking for work. This is a common criticism of the official unemployment measure, as it may understate true labor market distress.

How the U.S. Measures Unemployment

The Bureau of Labor Statistics (BLS) categorizes the population into different groups:

Employed – People who worked at least 1 hour in the past week (including part-time workers).

Unemployed (U-3) – People who are jobless, actively looked for work in the past 4 weeks, and are available to work.

Not in the Labor Force – People who are not working and not looking for work (e.g., retirees, students, discouraged workers).

Key Issue: If someone gives up looking for a job, they are no longer counted as unemployed—they are classified as "not in the labor force."

Alternative Measures of Unemployment (Including Discouraged Workers)

Because of this limitation, the BLS also publishes broader measures:

U-4: U-3 + "Discouraged workers" (those who stopped looking because they believe no jobs are available).

U-5: U-4 + "Marginally attached workers" (people who looked for work in the past year but not recently).

U-6 (Most Comprehensive): U-5 + Part-time workers who want full-time jobs ("underemployed"![]() .

.

Example (July 2024 Data):

Measure Definition Rate (July 2024)

U-3 Official unemployment 4.1%

U-6 Includes discouraged + underemployed 7.4%

This shows that the U-6 rate is almost twice as high as U-3, indicating hidden labor market weakness.

Criticism & Manipulation Claims

Some economists and commentators argue that the government underreports true unemployment by:

Ignoring Discouraged Workers – Millions have left the labor force since 2008 (especially after COVID-19).

Counting Part-Time as Employed – Even if someone works just 1 hour a week, they’re "employed."

Not Counting "Gig Economy" Struggles – Many workers in unstable jobs aren’t fully captured.

Sources & Further Reading:

BLS Unemployment Measures: BLS.gov

ShadowStats (John Williams): Claims real unemployment is closer to 22% if pre-1994 methods were used. (ShadowStats)

Forbes (2019): "Is The Real Unemployment Rate Twice The Official Rate?"

Conclusion

The official U-3 unemployment rate excludes discouraged and underemployed workers, making the labor market appear stronger than it might be. The U-6 rate is a better indicator of true job market stress.

Would you like historical comparisons (e.g., how unemployment was measured in the 1980s vs. today)?

CNYHarris

(113 posts)https://cis.org/Report/WorkingAge-Not-Working-1960-2024

When you tally those that left the workforce, many are able to make it because of crypto mining, family wealth, ... . ShadowStats does not reduce it for these many considerations.

If you were a worker in the US that went unemployed and could not find a job and then got married without a job, I don't think ShadowStats takes you off the unemployment rolls. As there is no reporting of this to statisticians. That is why the numbers are so different.

Wiz Imp

(6,647 posts)conspiratorial bullshit.

mahatmakanejeeves

(66,375 posts)progree

(12,240 posts)being 20-something percent. I spent more than an hour on his website following links and doing searches, but never could get beyond assertions - unless I paid $80 for full access that included a link to something that purported to provide the evidence.

This was several years ago. $80 wasn't and isn't a lot of money for me, but I know when my leg is being pulled.

It would make as much sense as putting money into a Bitcoin ATM to pay taxes and fees on winning a grand prize.

Paul Solman at PBS several years ago used to calculate a "U-7" unemployment rate which counted everyone who said they wanted a job and had no job currently (taken from responses to the BLS Household Survey that produces the official and other unemployment levels), even if they had not looked for a job for decades, plus part-timers who said they wanted a full-time job, and it was way under what ShadowStats was "reporting" at the time. I used to (years ago) duplicate his calculations when I was doing detailed job figures postings at the site in my sigline -- https://www.democraticunderground.com/111622439

BTW:

U-3, the official headline unemployment rate, counts only jobless people who have looked for work sometime in the last 4 weeks. In BLS parlance, these are people who are "actively seeking work". (part-time employees are considered employed in this measure, even if only one hour a week).

U-6, the most expansive version of unemployment rate that the BLS produces, counts people who have looked for work sometime in the last 12 months. It also counts part-time employees who say they want full-time work as unemployed (the U-3 counts them as employed).

Wiz Imp

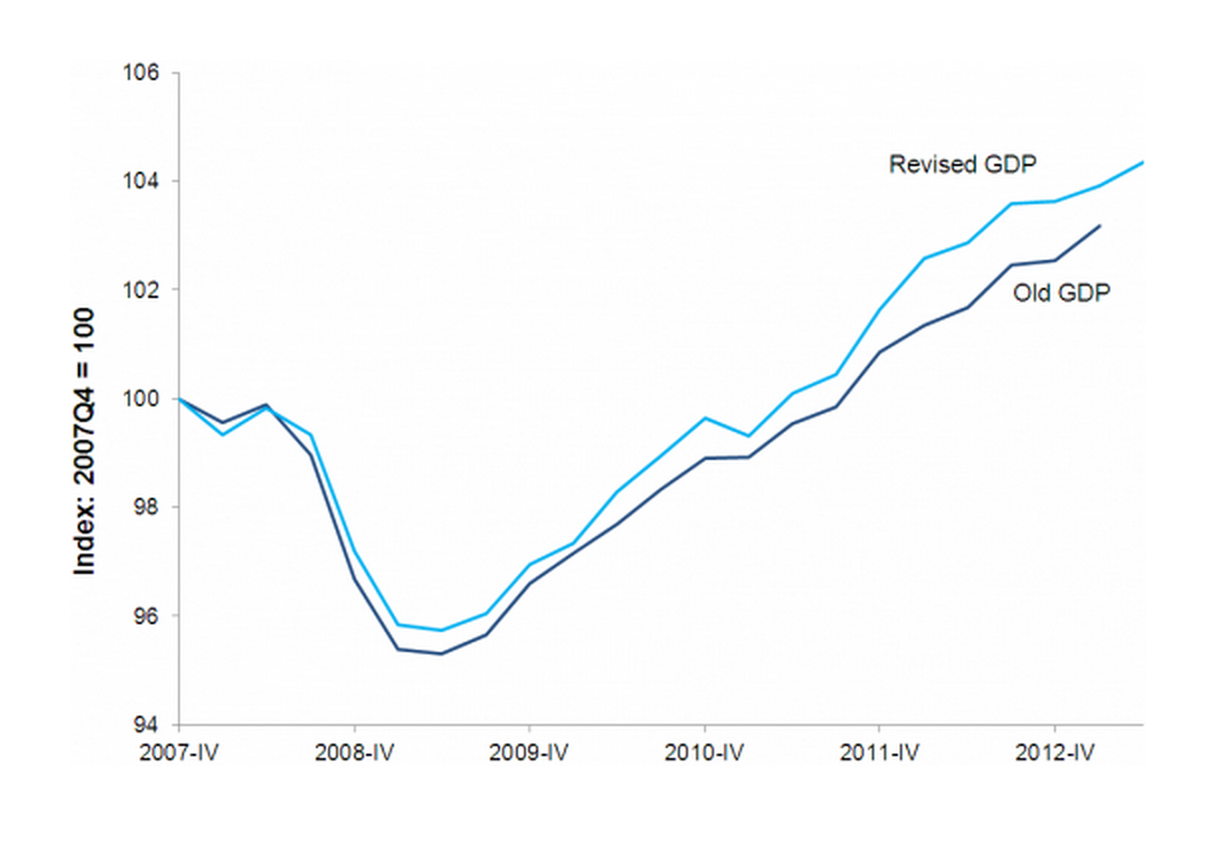

(6,647 posts)New Methods, Same Story

GDP Data Show U.S. Economy Is Far from Healed from the Great Recession

Economic Indicators • By Josh Bivens • July 31, 2013

Wiz Imp

(6,647 posts)thought crime

(685 posts)Bernardo de La Paz

(57,668 posts)The BLS professionals can't be fired by tRump the way the top spot could be.

There is good reason for wariness, but reflexive cynicism leads to poor decision-making.

Response to thought crime (Reply #68)

onenote This message was self-deleted by its author.

CNYHarris

(113 posts)Trump wants the endgame of the entire global economy revolving around the US in trade before the bitcoin roll out.

So the public does not turn against dictator Trump before that, fake the numbers until the nations of the globe submit to trade deals.

Bernardo de La Paz

(57,668 posts)CNYHarris

(113 posts)US exported dollars, exporting dollars does not produce manufacturing jobs. Trump wants to be the China of the globe in terms of trade.

Stock market cap is where the global economy revolved around the US. Investment and those types of issues. US exported dollars in trade.

Bernardo de La Paz

(57,668 posts)CNYHarris

(113 posts)see here:

https://howmuch.net/articles/trade-timelapse-usa-china

Services is the only thing the US has left in trade.

SunSeeker

(56,501 posts)CNYHarris

(113 posts)US runs hundreds of billions in trade deficits. How does it do this, it exports dollars. The globe mops up the dollars because it is the global reserve currency.

Trump wants to destroy the old order, impose US total dominance in trade for the global economy, this causes massive chaos. You need to cook the books to hide the misery. So for the Trump plan to work, hide the misery because the endgame of the US owning the globe via trade is more important than those that suffer from the trade wars.

Bernardo de La Paz

(57,668 posts)The graphic is "brutal" until you look more closely.

Bernardo de La Paz

(57,668 posts)CNYHarris

(113 posts)Any occasion when Philly scored it touchdown or field goal, the ref counted that as a score for the opponent because they could fake the numbers.

There is no reason to put any stock into anything the Trump regime says, they are faking it until the endgame of total control. Anything that would get the public against Trump, either the cosplay White House fakes or the legacy media ignores. We are worse than Russia at this point because at least Russia the public knows they fake democracy and steal elections.

Bernardo de La Paz

(57,668 posts)Johnny2X2X

(23,223 posts)Inflation is clearly rising, and the tariffs are just starting to show up in the data.

And Core is the headline on Yahoo Finance

https://finance.yahoo.com/news/cpi-core-inflation-rises-by-most-in-six-months-stoking-tariff-driven-price-concerns-130820737.html

DallasNE

(7,858 posts)Food prices flat? I don’t think so. In late July I saw steak prices jump by $1 a pound. Flat, that is not. (Went from $17.97 a pound to $18.97 a pound).

Wiz Imp

(6,647 posts)The revisions are to seasonal adjustment factors and the expenditure weights. Only the chained CPI is subject to monthly revisions.

Bernardo de La Paz

(57,668 posts)kimbutgar

(25,850 posts)Last time, I brought the same 5 lbs it was $19.

And there were few selections of coffee bean types as the shelves were picked over.

progree

(12,240 posts)Today's report is a collection of price observations taken throughout the month of July (there's no "survey week" for the CPI like there is for the big "First Friday" jobs report).

I presume they just average the price observations taken through the month for each item.

Someone upthread reported a big increase in meat prices at the end of July. But since they (presumably) average such observations taken throughout the month of July, it would not have a big impact on the average. (In other words, don't think of the July report as being an estimate of prices at the end of July).

As for individual observations, I was impressed by this link someone gave us upthread:

https://www.consumeraffairs.com/finance/cost-of-groceries-by-state.html

The big take-away for me was the wide variation in food inflation by state and locality. So one person's food inflation experience is often quite different from another's (leaving aside perceptual biases, like focusing on one or two items with big increases).

But note that, even though it says "Updated 10 July 2025" at the very top, most of what follows is as of November 2024 and some graphs end in October 2023. So while I think this link is good for generally showing geographic variations, it seems to be all pre-Krasnov as far as data.

onenote

(45,586 posts)This report doesn't cover what you paid yesterday. It covers last month.