Economy

Related: About this forumS&P 500 closed Tuesday 2/24 at 6890, up 0.8% ## Slight upticks on still very lousy consumer confidence and ADP payrolls

Last edited Tue Feb 24, 2026, 10:24 PM - Edit history (253)

In the future I will only be doing these twice a week: Tuesday and Friday, unless it's really interesting.10 Year TREASURY YIELD 4.03% on Feb 24, down from 4.09% on Feb 20. It was 4.27% on Feb 3. It was 4.19% on Friday 12/12 (It local-bottomed out at 3.95% 10/22/25, its lowest point since April.)

https://finance.yahoo.com/quote/%5ETNX/

10 Year Treasury price: https://finance.yahoo.com/quote/ZN%3DF/

Bitcoin: $64,086 @ 427p ET Feb 24, down from $68,597 @ 2/21 148p # It was $75,512 @ 6:50 PM ET Feb 3. It was $84,009 @ 944pm ET Friday 1/30. It was $95,401 @ 533p ET 1/16/26, It recently exceeded at last it's end of year 2024 closing level ($93,429), but it's back below the waterline on that metric, , It's in bear market territory, down more than 20% from it's $126,000+ all-time high in October (20% down from $126,000 is $100,800) ACTUALLY, it's down 49% from $126,000 (Cryptocurrencies trade 24/7) https://finance.yahoo.com/quote/BTC-USD/

Next Fed rate decision: March 18 (last was January 28)

CME FedWatch tool (probabilities of various Fed interest rate moves) 1/30: 13% chance of a rate cut), 2/10: 20% chance, 2/13: 9% chance, 2/20: 3% chance

. . . https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The S&P 500 closed Tuesday February 24 at 6890, up 0.8% for the day,

and down 0.3% from Friday,

and up 19.1% from the 5783 election day closing level,

and up 14.9% from the inauguration eve closing level,

and up 17.1% since the December 31, 2024 close

and up 0.7% Year-To-Date (since the December 31, 2025 close)

https://finance.yahoo.com/quote/%5EGSPC

(more below on the S&P 500 levels corresponding to the above, and also the Dow)

Market news of the day: https://finance.yahoo.com/

How to find the latest Yahoo Finance "stock market today" report if it's not at the finance.yahoo page (note that the headline displayed there does not include the "Stock Market Today" words, but the article itself does): click on

https://www.google.com/search?q=%22stock+market+today%22+site%3Afinance.yahoo.com&oq=%22stock+market+today%22+site%3Afinance.yahoo.com

If the link doesn't work for you,

Google: "stock market today" site:finance.yahoo.com

First I will briefly cover Monday. Then on to Tuesday

Monday Feb 23

S&P 500 down 1.04%, Dow down 1.66% (822 points), NASDAQ down 1.13%, Russell 2000 down 1.61%

https://finance.yahoo.com/news/live/stock-market-today-dow-drops-800-points-as-sp-500-nasdaq-slide-on-trump-tariff-fears-ai-scare-trade-210027026.html

US stocks retreated on Monday as investors grappled with the fallout from the Supreme Court's rebuff of President Trump's most sweeping tariffs, while AI disruption fears gripped markets once again.

Growing uncertainty about the global trade landscape is unsettling markets. The Supreme Court's invalidation of many US tariffs on Friday initially fueled trade hopes and buoyed stocks. But Wall Street is reassessing after Trump said Saturday that the US will lift the baseline tariff rate on imports to 15%, effective immediately. ((update - per a report Tuesday 2/24, admin announced 10% --progree))

In a strong response, the EU rejected any hike in tariffs, saying "a deal is a deal" and calling on Washington to clarify the steps it will take.

Meanwhile, the "AI scare trade" resumed on Monday, after Anthropic announced an AI tool designed to automate analysis and tasks typically done by expensive consulting teams. Shares of IBM (IBM) shares sank 13%, while Accenture (ACN) and Cognizant Technology (CTSH) also fell.

Industries across the board, including software, real estate and logistics, have gotten hit over the past several weeks amid concerns that AI tools will disrupt business models and squeeze margins.

Looking ahead, AI chipmaker Nvidia's (NVDA) results on Wednesday are the earnings highlight as the season continues to wind down, and as AI disruption fears swirl. Nvidia shares were a rare green spot for the market on Monday.

--- SCROLLING DOWN THE PAGE, Monday February 23 -----

Stocks fall as AI scare trade resumes, Trump tariff uncertainty emerges

BofA: 'Misinformation' around Blue Owl makes the stock an attractive buy

Blue Owl Capital's (OBDC) shares have been punished over the last week after news that the firm was suspending redemptions from one of its private credit funds. The move prompted a renewed surge in worries around private credit markets, and shares have dropped roughly 8% over the past month.

Gold climbs to three week high, silver jumps on tariff uncertainty

Treasury yields fall as investors turn to bonds amid flight to safety

Payments stocks get dragged into the risk-off wave ((payments and e-commerce stocks -progree))

Hedge funds sell global stocks at fastest pace since 'Liberation Day' meltdown

Novo's stock falls as obesity drug falls short against Lilly's in trial

From Wednesday but worth another day in the highlights --

BofA: Corporate profits rise while labor income falls, 'fueling K-shaped economy'

*There's a graph from 2006 on: Wages and salaries as a percent of GDP, compared to Corporate profits as a percent of GDP

The wages and salaries, at about 7.4% of GDP in the latest point on the graph, is lower than any point on the graph, per progreerian eyeballs

Tuesday February 24

S&P 500: +0.77%, Dow +0.76% (370 points), NASDAQ +1.04%,

10Y TREASURY 4.03% +0.00,

Bitcoin: $64,086 @ 427p ET

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-as-software-leads-ai-relief-rally-ahead-of-nvidia-earnings-210010666.html

US stocks rose Tuesday, with software stocks leading the charge as Wall Street as worries over AI disruptions eased ahead of Nvidia (NVDA) earnings this week.

. . . The tech-heavy Nasdaq Composite (^IXIC) gained about 1% as AMD (AMD) shares surged after the chipmaker entered a deal to provide Meta (META) with a huge amount of GPUs for the Facebook owner's AI build-out.

The rebound follows a sharp sell-off on Monday as investors grappled with renewed concerns that rapid advances in AI could disrupt broad swaths of corporate America.

That put the spotlight on Anthropic's (ANTH.PVT) virtual event on Tuesday morning, featuring updates to its AI tools and Claude chatbot for companies. The company announced partnerships with several software companies, including Salesforce (CRM), FactSet (FDS), and DocuSign (DOCU), sparking rallies in their respective stocks.

All eyes will be on AI chip heavyweight Nvidia when it posts quarterly results on Wednesday after the market close.

Meanwhile, worries of a revived trade war are still keeping markets on edge, after President Trump's new 10% global tariff took effect on Tuesday. Investors will listen closely to Trump's State of the Union address later Tuesday for hints on his trade policy as he lays out his view of the economy.

--- SCROLLING DOWN THE PAGE, Tuesday February 24 -----

Software gets a bounce, but the chart isn’t forgiven

The good news: Anthropic (ANTH.PVT) is going out of its way to sell the “we partner with software” story, highlighting Claude tie-ups with Thomson Reuters (TRI), FactSet (FDS), Salesforce (CRM) via Slack, and DocuSign (DOCU) across what it calls “work surfaces.”

The earlier investor read was darker — that Claude was coming for the whole workflow layer in corporate America.

. . .

Still, today’s sea of green doesn’t erase the damage. Most names are still down double digits since the early-February “AI scare” flush.

Goldman Sachs warns AI-fueled layoffs could raise the unemployment rate this year

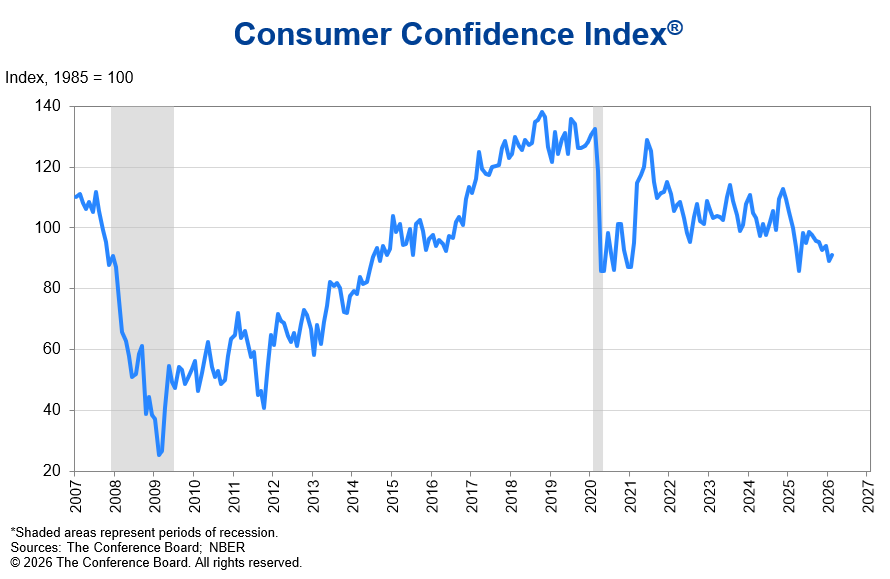

Consumer confidence rises in February, but the trend is 'pretty disturbing,' economist says

Fed Gov. Lisa Cook: Standard Fed policy may struggle to counteract AI-driven unemployment

The article has comments from several other Fed big-wigs

Waymo expands robotaxi service to Dallas, Houston, San Antonio, and Orlando

JPMorgan Chase (JPM) CEO Jamie Dimon warns markets resemble pre-financial crisis era: 'I see a couple of people doing some dumb things'

=============================================

=============================================

=============================================

=============================================

CALENDAR

Recent and Coming Up, Reports (I'm also keeping February 16 and later ones for now, I put the older ones in reply #1

https://www.marketwatch.com/economy-politics/calendar

See Reply #1 to this thread for reports prior to February 16.

The government reports are all seasonally adjusted, as are most, if not all, of the non-government reports the media covers, so please don't post comments about how the numbers look good (or not as bad as expected) only because of Christmas season hires or Christmas shopping. Or that it's warming up and people are beginning spring shopping already -- seasonal factors like that have been adjusted for

LAST WEEK'S REPORTS (Feb 16-20) FOLLOWED BY THIS WEEK'S REPORTS (FEB 23-27) FOLLOWED BY NEXT WEEK'S CALENDAR (MAR 2-6)

I tried putting last week's report at the end so people don't have to scroll through them to see this week's reports. But it got to be confusing and harder to find things, so for now, it's all in chronological order.

LAST WEEK'S REPORTS (FEB 16-20)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY FEB 16

None scheduled, President's Day holiday

TUESDAY FEB 17

Nothing

WEDNESDAY FEB 18

# Housing Starts for November and December

Housing starts jump to 5-month high in December

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "housing starts"

Yes, I wish Yahoo would give these articles their own URL.

This report followed Tuesday's read on homebuilder confidence from the NAHB, which showed sentiment fell by another point to 36 this month, the lowest reading since September.

**FRED graph shown in the article, graph is titled: "New Privately-Owned Housing Units Started, Total Units" from 2016 onward

# Building Permits for November and December

December was 1.32 million vs. 1.31 million expected and 1.27 million previously, according to https://www.marketwatch.com/economy-politics/calendar

# Durable Goods Orders for December

Durable goods orders were down 1.4% in December vs. down 2.0% expected, and +5.4% previously according to https://www.marketwatch.com/economy-politics/calendar . I believe these are seasonally adjusted. I don't have an explanation, I haven't looked for an article.

# Industrial Production and Capacity Utilization for January

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "industrial production"

Yes, I wish Yahoo would give these articles their own URL.

US industrial production grew in January by widest monthly margin since March 2025 (+0.7%. It was the largest month-on-month percentage increase since March 2025,

# Minutes of Fed's January FOMC meeting

THURSDAY FEB 19

# Leading economic index for December Conference Board (non-governmental)

US leading indicators forecast slow start to 2026, Wall St. Journal via MSN (no paywall), 2/17/26

https://www.msn.com/en-us/money/markets/us-leading-indicators-forecast-slow-start-to-2026/ar-AA1WG60g

ULTIMATE SOURCE: https://www.conference-board.org/topics/us-leading-indicators/index.cfm

# Unemployment insurance claims

US weekly jobless claims fall more than expected amid labor market stability (dropped 23k to 206k in week ending Feb 14 ## Continuing claims week ending Feb 7 ROSE 17k to 1.869 M), Reuters, 2/19/26

https://finance.yahoo.com/news/us-weekly-jobless-claims-fall-134542016.html

. . .continuing claims suggested that laid-off workers were experiencing difficulties finding new positions.

The median duration of unemployment is near four-year highs. The lack of hiring has significantly impacted recent college graduates, who because of no or limited work history, cannot file for unemployment benefits and are not captured in the claims data.

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf

This report's permalink: https://www.dol.gov/newsroom/releases/eta/eta20260219

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

# U.S. trade deficit for December (the Commerce Dept)

U.S. trade deficit slipped to $901 billion last year amid Trump tariffs, AP, 2/19/26

https://finance.yahoo.com/news/u-trade-deficit-slipped-901-134134850.html

From $904 billion in 2024 to $901 B in 2025.

The trade gap surged from January-March as U.S. companies tried to import foreign goods ahead of Trump’s taxes, then narrowed most of the rest of the year.

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Friday on GDP)

# Advanced U.S. trade balance in goods for December

See above AP story

# Mortgages rates

Mortgage rates drop to lowest level in nearly 4 years

https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-rates-drop-to-lowest-level-in-nearly-4-years-110045487.html

FRIDAY FEB 20

# GDP Q4 FIRST ESTIMATE

2.5% annualized growth expected, 1.4% is what happened according to the Commerce Department's Bureau of Economic Analysis (BEA)

Q3 was 4.4% annualized rate (I know I know, but the AI spending counts as GDP, even if it produces nothing useful)

Yes, the reported GDP numbers are inflation-adjusted

Full year GDP's: 2024: 2.8%. 2025: 2.2%

LBN Thread: https://www.democraticunderground.com/10143619093

ULTIMATE SOURCE:

. . . https://bea.gov/data/gdp/gross-domestic-product

. . . https://bea.gov/news/current-releases

. . . https://bea.gov/news/2026/gdp-advance-estimate-4th-quarter-and-year-2025

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Thursday on trade balance)

# PCE Inflation for December - Fed's favorite inflation gauge

Expected: month-over-month: 0.3%, year-over-year: 2.8% (both numbers same as November's)

What happened: month-over-month: regular PCE (includes food and energy) +0.4%

Core PCE (doesn't include food or energy): +0.4%

12 month average (year-over-year): regular PCE: +2.9%, core PCE: +3.0%

LBN thread (this leads off with the GDP, but also includes PCE inflation): https://www.democraticunderground.com/10143619093

GRAPHS: rolling averages of 3 months and 12 months. And month-over-month bar chart. Both regular and core:

. . . https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3619273

This inflation gauge fully includes substitution effects, so for example if beef prices are way up and a lot of consumers switch to turkey necks, this inflation gauge will show a subdued rise or even a drop in the meat price index. But I suspect the Fed likes it because it tends to produce a lower inflation rate than the CPI.

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

. . . PCE DATA SERIES: https://fred.stlouisfed.org/series/PCEPI

. . . CORE PCE DATA SERIES: https://fred.stlouisfed.org/data/PCEPILFE

# Personal Income and Spending for December

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

# S&P flash U.S. services PMI for February

# S&P flash U.S. manufacturing PMI for February

# New home sales for November and December

# Consumer sentiment (prelim) for February

Consumer sentiment in February shows high prices weigh on US households, but Supreme Court could offer relief, Yahoo Finance, 2/20/26 https://finance.yahoo.com/news/consumer-sentiment-in-february-shows-high-prices-weigh-on-us-households-but-supreme-court-could-offer-relief-161122277.html

The University of Michigan's Index of Consumer Sentiment for February came in at 56.6, up 0.4% from January, but below last year's level of 64.7. The small increase was lower than the 57.2 reading expected by economists. (Be sure to look at the graph that shows the scale of the teeny tiny up-tick still leaving it at incredibly low levels historically.

ULTIMATE SOURCE: https://www.sca.isr.umich.edu/

GRAPH, 10 years: https://www.sca.isr.umich.edu/files/chicsr.pdf

GRAPH, 50 years: https://www.sca.isr.umich.edu/files/chicsh.pdf

THIS WEEK'S REPORTS/CALENDAR (FEB 23-27)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY FEB 23 (REPORTS)

# Factory orders December

-0.7%. ; +0.2% expected. ; Previous time: +2.7%. Year-over-year: +3.7%

https://finance.yahoo.com/news/us-factory-orders-fall-december-154841615.html

New orders for U.S. factory goods fell in December amid a sharp decline in commercial aircraft bookings, but demand elsewhere was strong, partly driven by robust investment in artificial intelligence.

Factory orders dropped 0.7% after an unrevised 2.7% increase in November, the Commerce Department's Census Bureau said on Monday.

Economists polled by Reuters had forecast factory orders would slip 0.6%. Orders advanced 3.7% on a year-on-year basis in December. The report was delayed by last year's government shutdown,

. . . Manufacturing, which accounts for 10.1% of the economy, has been hamstrung by President Donald Trump's sweeping tariffs, which business leaders say have raised costs for factories and consumers. But some sections have been supported by the rapid adoption of AI.

TUESDAY FEB 24 (REPORTS)

# ADP NER Pulse private payrolls weekly estimate - For the four weeks ending February 7, 2026, private employers added an average of 12,750 jobs a week. It was the fourth straight week of strengthening job gains.

SOURCE: https://www.adpresearch.com/ and search for Pulse

https://www.adpresearch.com/what-happened-to-labor-market-dynamism/ search for "NER Pulse" to see the graph

GRAPH:

Multiplying by 365 / (12*7) to "monthesize it" to the average month: 55,400

Compare to latest from BLS: 172,000 PRIVATE SECTOR jobs added in January

. . . https://www.bls.gov/news.release/empsit.t17.htm

Economy Group Thread: https://www.democraticunderground.com/1116101728

# S&P Case-Shiller home price index (20 cities), December

Up 1.4%, same as November, which was also up 1.4%.

# Consumer confidence, February

91.2. 88.6 was expected. Previous time: 89.0.

From the source: https://www.conference-board.org/topics/consumer-confidence/

For graphs, click above link -- the uptick is almost imperceptible. It remains at about the same level as it averaged in the first 9 months of the pandemic

WEDNESDAY FEB 25 (CALENDAR)

NVIDIA's earnings expected around 4:30 PM ET

THURSDAY FEB 26 (CALENDAR)

# Unemployment insurance claims

FRIDAY FEB 27 (CALENDAR)

# PPI Producer Price Index aka wholesale prices, January - last time the month-over-month was a whopping 0.5%, that's roughly a 6% annualized rate, and the year over year was 3.0% (the core PPI year-over-year was 3.5%). The Krasnov Krasnov! Brigade was eerily silent about that one.

NEXT WEEK'S CALENDAR (MAR 02-06)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY MARCH 2

# S&P final U.S. manufacturing PMI Feb.

# ISM manufacturing Feb

TUESDAY MARCH 3

Nothing

WEDNESDAY MARCH 4

# ADP private sector employment (non-govt) Feb.

# S&P final U.S. services PMI Feb.

# ISM services Feb.

# Fed Beige Book

THURSDAY MARCH 5

# Initial jobless claims week ending Feb. 28

# U.S. productivity, Q4

# Import price index, Feb.

FRIDAY MARCH 6

# Big "First Friday" BLS jobs report headlining non-farm payrolls and unemployment rate

The full calendar: https://www.marketwatch.com/economy-politics/calendar

Revised release dates for Bureau of Labor Statistics reports: https://www.bls.gov/bls/2025-lapse-revised-release-dates.htm

BEA.GOV news release schedule (they produce reports on the GDP, Retail Sales, PCE Inflation (the Fed's favorite inflation gauge), and Personal Consumption and Income: https://www.bea.gov/news/schedule

ADP NER Pulse (private payrolls weekly update): Is every Tuesday. The ultimate source: https://www.adpresearch.com/

and look for "NER Pulse"

Archives of previous reports

The monthly payroll employment reports from the BLS are archived at Archived News Releases (https://www.bls.gov/bls/news-release/ ). In the list up at the top, under Major Economic Indicators, select Employment Situation ( https://www.bls.gov/bls/news-release/empsit.htm ) . That opens up links to reports going back to 1994. (Includes CPI, ECI, many others)

Unemployment insurance claims archives: https://oui.doleta.gov/unemploy/claims.asp . If that doesn't work, start with https://oui.doleta.gov/unemploy/claims_arch.asp and click on "Weekly Claims Data" near the very bottom.

BEA's Data Archive https://www.bea.gov/news/archive

--------------------------

Erika McEntarfer (fired former BLS Commissioner) "Person who was fired here - you should still trust BLS data." - The agency is being run by the same dedicated career staff who were running it while I was awaiting confirmation from the Senate. And the staff have made it clear that they are blowing a loud whistle if there is interference." https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3614986

=============================================

=============================================

=============================================

=============================================

The S&P 500 closed Tuesday February 24 at 6890, up 0.8% for the day,

and down 0.3% from Friday,

and up 19.1% from the 5783 election day closing level,

and up 14.9% from the inauguration eve closing level,

and up 17.1% since the December 31, 2024 close

and up 0.7% Year-To-Date (since the December 31, 2025 close)

S&P 500

# Election day close (11/5/24) 5783

# Last close before inauguration day: (1/17/25): 5997

# 2024 year-end close (12/31/24): 5882

# Trump II era low point (going all the way back to election day Nov5): 4983 on April 8

# 2025 year-end close (12/31/25): 6845

# October 28 all-time-high: 6890.90, surpassed by December 24's all-time high of 6932.00

# Several market indexes: https://finance.yahoo.com/

# S&P 500: https://finance.yahoo.com/quote/%5EGSPC/

https://finance.yahoo.com/quote/%5EGSPC/history/

# S&P 500 futures: https://finance.yahoo.com/quote/ES%3DF/

Bitcoin

Bitcoin ended 2024 at $93,429. https://finance.yahoo.com/quote/BTC-USD/

Bitcoin's all-time interday high: 126,198 on Oct. 6

Bitcoin's all-time closing high: 124,753 on Oct 6. (that's what Yahoo Finance shows, but cryptocurrencies trade 24/7)

https://finance.yahoo.com/quote/BTC-USD/history/

========================================================

I'm not a fan of the DOW as it is a cherry-picked collection of just 30 stocks that are price-weighted, which is silly. It's as asinine as judging consumer price inflation by picking 30 blue chip consumer items, and weighting them according to their prices. But since there is an automatically updating embedded graphic, here it is. It takes several, like 6 hours, after the close for it to update, like about 10 PM EDT.

(If it still isn't updated, try right-clicking on it and opening in a new tab. #OR# click on https://finance.yahoo.com/quote/%5EDJI/ ).

The Dow closed Monday at 48,804, and it closed Tuesday at 49,175, a rise of 0.8% (370 points) for the day

https://finance.yahoo.com/

DOW: https://finance.yahoo.com/quote/%5EDJI/

. . . . . . https://finance.yahoo.com/quote/%5EDJI/history/

DOW

# Election day close (11/5/24) 42,222

# Last close before inauguration day: (1/17/25): 43,488

# 2024 year-end close (12/31/24): 42,544

# 2025 year-end close (12/31/25): 48,063

DJIA means Dow Jones Industrials Average. It takes about 6 hours after the close to update, so check it after 10 PM EDT. Sometimes it takes a couple days (sigh)

I don't have an embeddable graph for the S&P 500, unfortunately, but to see its graph, click on https://finance.yahoo.com/quote/%5EGSPC/

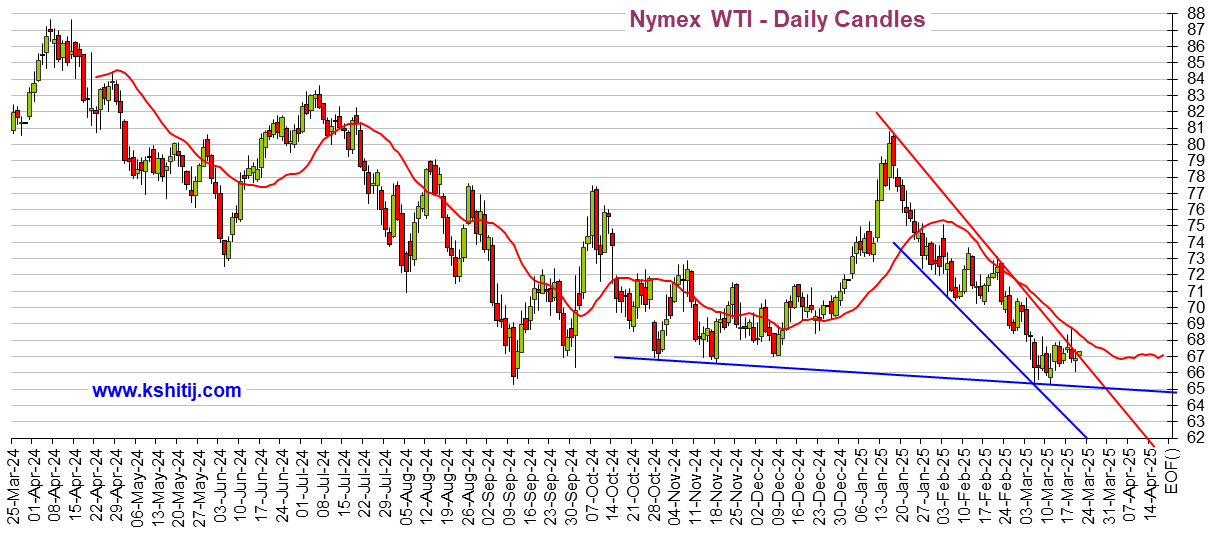

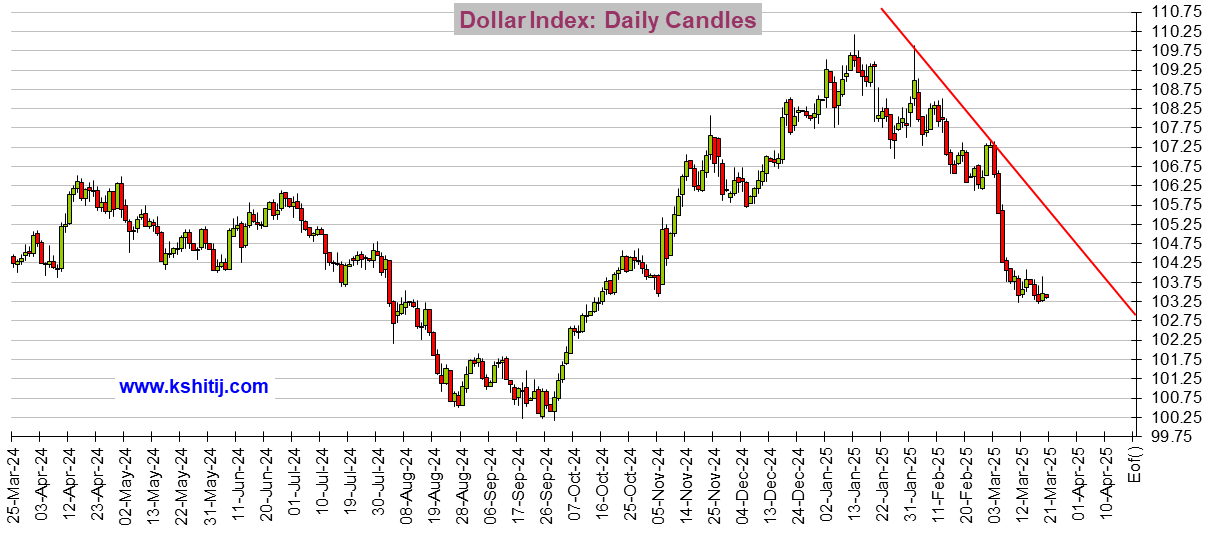

While I'm at it, I might as well show Oil and the Dollar:

Crude Oil

US Dollar Index (DX-Y.NYB)

If you see a tiny graphics square above and no graph, right click on the square and choose "load image". There should be a total of 3 graphs. And remember that it typically takes about 6 hours after the close before these graphs update.

🚨 ❤️ 😬! 😱 < - - emoticon library for future uses

progree

(12,860 posts)Last edited Tue Feb 24, 2026, 10:28 PM - Edit history (9)

Most Recent First (reverse chronological order)FRIDAY FEB 13

# Consumer price index Jan.

LBN Thread: https://www.democraticunderground.com/10143615668

A lot of response from the Krasnov Krasnov! Brigade. But they were eerily absent when the latest PPI (Producer Price Index, aka Wholesale Prices) report reported a 0.5% increase in December (that's a 6.0% annualized rate), and 3.0% over the past 12 months (their core measure was 3.5% over the past 12 months) https://www.democraticunderground.com/10143608234 (see Reply #1 for more on that 1/30/26 report with the title, "Wholesale prices rise sharply and show new Fed chief could confront stubborn inflation" )

Back to CPI - here's the core part of it, which is considered by the Federal Reserve as more representative of underlying trends and more predictive of FUTURE inflation - assertions that have been back-tested. This one is a rolling 3 month average, so that it's more than a "One off" of the latest month, but with much more recency than year-over-year. It shows a distinctive up-turn

The regular CPI's 3 month rolling average also has risen the last 2 months in a row, although not as sharply. So much for "cooling inflation" I guess.

Chicago Fed's Goolsbee says interest rates could fall 'a fair bit more,' but more inflation progress is needed, Yahoo Finance, 2/13/26

https://finance.yahoo.com/news/chicago-feds-goolsbee-says-interest-rates-could-fall-a-fair-bit-more-but-more-inflation-progress-is-needed-210239035.html

He is concerned about services inflation which tends to be persistent and not driven by tariffs (so an easing of tariffs isn't going to help much with services inflation, and if the impact of tariffs is a one-time thing, as many think, that's not going to help with services inflation. Says inflation has been above the target for more than 4.5 years now)

THURSDAY FEB 12

# Unemployment insurance claims

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf

This report's permalink: https://www.dol.gov/newsroom/releases/eta/eta20260212

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

...

The advance number for seasonally adjusted insured unemployment ((also known as continuing claims -progree)) during the week ending January 31 was 1,862,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 1,844,000 to 1,841,000.

# Existing home sales Jan.

https://www.cnbc.com/2026/02/12/january-homes-sales.html

. . . The chief economist for the National Association of Realtors, Lawrence Yun, is calling it “a new housing crisis.”

Sales of previously owned homes in January dropped a much wider-than-expected 8.4% from December to a seasonally adjusted, annualized rate of 3.91 million, according to the NAR. Sales were 4.4% lower than January 2025. That is the slowest pace since December 2023 and the biggest monthly drop since February 2022. The median price for a home sold in January was $396,800, up 0.9% year over year and the highest January price on record.

WEDNESDAY FEB 11

# The big "First Friday" monthly BLS jobs report that produces the headline non-farm payroll jobs number and unemployment rate - January

Ultimate source of the latest release: https://www.bls.gov/news.release/empsit.nr0.htm

Permanent copy of this January report: https://www.bls.gov/news.release/archives/empsit_02112026.htm

LBN Thread: https://www.democraticunderground.com/10143614651

The before and after the big jobs revisions, month by month:

https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3615236

Here's a summary table showing the annual totals:

Annual Totals, in thousands

Year Before After Difference

2022] 4555 4526 -29

2023] 2594 2515 -79

2024] 2012 1459 -553

2025] 584 181 -403

2025 comes out to an average of 15k jobs/month. If you remove January, it is 21k/month. A barely above-the-waterline record.

And yet most media headlines are about a big surge in jobs (130,000) in January. 130,000 is not a big number, but relatively speaking it's a "surge" compared to the pathetic average monthly jobs growth in 2025.

The unemployment rate (from a separate survey, the Household Survey) fell from 4.4% to 4.3% (It was 4.0% in January 2025, a year ago)

The Household Survey's "Employed" number increased by just 689,000 since January 2025 ( 57,000 / month average ).

Increase in private sector payroll jobs (for comparison to ADP): +172k

TUESDAY FEB 10

# NFIB optimism index, January

US small-business confidence slipped in January, Wall St. Journal, 2/10/26 (no paywall or gimmicks at this MSN-hosted article)

https://www.msn.com/en-us/money/smallbusiness/us-small-business-confidence-slipped-in-january/ar-AA1W33sy

# US consumer delinquencies jump to highest in almost a decade, Bloomberg, 2/10/26

https://www.msn.com/en-us/money/markets/us-consumer-delinquencies-jump-to-highest-in-almost-a-decade/ar-AA1W4vwC

I haven't had time to read this article, but title is sure gloomy.

# Employment Cost index, Q4 - Considered the best statistic on wages/salaries and benefits, and the Federal Reserve's favorite source on the same.

Economy Group post: https://www.democraticunderground.com/1116101681

From the source: https://www.bls.gov/eci/

Some context:

By fixing workforce composition, the ECI provides a more accurate picture of what is actually happening to wages.

[1] The Pandemic’s Effect on Measured Wage Growth, The WHite House, 4/19/21 ((Biden era))

. . . Original link now gone, thanks to Krasnov: https://www.whitehouse.gov/cea/written-materials/2021/04/19/the-pandemics-effect-on-measured-wage-growth/

. . . The Archive.org link: https://web.archive.org/web/20220208080743/https://www.whitehouse.gov/cea/written-materials/2021/04/19/the-pandemics-effect-on-measured-wage-growth/

# Import price index

This is another one I don't have time to look into now

# Retail sales - caution: not inflation-adjusted, so one gets a distorted view of increases in retail sales, when often most of that is simply due to price increases. It is seasonally adjusted.

RETAIL SALES DECEMBER over November: +0.0%, Inflation was 0.31%, so inflation-adjusted retail sales were down about 0.3% for the month

RETAIL SALES for the 12 month period through December (i.e. year-over-year): +2.4%, Inflation: +2.7%, so inflation-adjusted retail sales were down about 0.3% for the 12-month period

LBN Thread: https://www.democraticunderground.com/10143614155

From the Source: https://www.census.gov/retail/index.html -- > https://www.census.gov/retail/sales.html :

Remember the below numbers are not inflation adjusted

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USN), Not Seasonally Adjusted: +10.9% == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USN

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USS), Seasonally Adjusted: +-0.0% == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USS

And so the seasonal adjustment process turned a 10.9% increase to 0.0% in December (remember it's the Christmas month ho ho ho)

CPI inflation: https://data.bls.gov/timeseries/CUSR0000SA0

MONDAY FEB 09

Nothing

FRIDAY FEB 06

# Consumer sentiment (preliminary) - February

Consumer sentiment hits highest level since August, but is down 11% from year ago

https://finance.yahoo.com/news/consumer-sentiment-hits-highest-level-since-august-but-down-11-from-year-ago-as-inflation-job-worries-weigh-155341347.html

SOURCE: https://www.sca.isr.umich.edu/

GRAPH, 10 years: https://www.sca.isr.umich.edu/files/chicsr.pdf

GRAPH, 50 years: https://www.sca.isr.umich.edu/files/chicsh.pdf

It's definitely an uptick, but a very small uptick. It's at about the lowest point seen in the post-pandemic 2022 inflation peak, and definitely below the worst levels of the housing bubble and dot-com crashes.

. . .

Friday's reading from the University of Michigan also showed a divergence based on exposure to the stock market, though the report noted responses to this survey were collected prior to the onset of the software-led tech sell-off that started earlier this week.

"Sentiment surged for consumers with the largest stock portfolios, while it stagnated and remained at dismal levels for consumers without stock holdings," Hsu said.

THURSDAY FEB 05

# JOLTS - Job Openings and Labor Turnover Survey - December -

Job openings sink in December to lowest level since 2020

https://finance.yahoo.com/news/job-openings-sink-in-december-to-lowest-level-since-2020-151605057.html

Layoffs and discharges, at 1.8 million, increased slightly from 1.7 million a month earlier.

The hiring rate, meanwhile, improved slightly from a month prior, reaching 3.3%. The quits rate, often seen as a barometer of workers' confidence to jump from their current post to search for greener pastures, also remained at 2%.

# Unemployment insurance claims

US weekly jobless claims rise by more than expected

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-sell-off-builds-as-tech-rout-continues-bitcoin-plunges-210019775.html

(and scroll way down)

Continuing claims, a proxy for the total number of people receiving state unemployment benefits, increased to 1.84 million.

More on continuing claims for the week ending January 24 was 1,844,000, an increase of 25,000 from the previous week's revised level. The previous week's level was revised down by 8,000 from 1,827,000 to 1,819,000.

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf . . . this release's permalink is at https://www.dol.gov/newsroom/releases/eta/eta20260205

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

WEDNESDAY FEB 04

# ADP employment (private sector workforce) - January. ADP processes payrolls for 20% of the private sector payroll employed, and estimates somehow the other 80%. It's a non-governmental report, so the report's timing is not subject to the government shutdown/startup schedule.

Private payrolls rose by just 22,000 in January, far short of expectations, ADP says, CNBC, 2/4/26

https://www.democraticunderground.com/10143611175

The total was less than the downwardly revised 37,000 increase in December and below the Dow Jones consensus forecast for 45,000.

The ultimate source: https://adpemploymentreport.com/

Seasonal adjustment turned a 2.171 Million job loss into a 22,000 gain - details: https://www.democraticunderground.com/10143611175#post15

Monthly, Not Seasonally Adjusted

https://fred.stlouisfed.org/series/ADPMNUSNERNSA

Monthly, Seasonally Adjusted:

https://fred.stlouisfed.org/series/ADPMNUSNERSA

TUESDAY FEB 03

# ISM Services - January

MONDAY FEB 02

# ISM manufacturing - January -

FRIDAY JAN 30

# PPI Producer price index (aka wholesale prices) (delayed report) DECEMBER

REGULAR PPI: DECEMBER: +0.5% (Oct: +0.1%, Nov: +0.2%), 12 months: +3.0%

CORE PPI (ex food, energy, trade services): DECEMBER: +0.4%, 12 months: +3.5%

LBN THREAD: https://www.democraticunderground.com/10143608234

BLS SOURCE: https://www.bls.gov/news.release/ppi.nr0.htm

2/3 of the broad-based December rise in prices for final demand services can be traced to a 1.7-percent jump in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.)

----- Data Series ----

PPI http://data.bls.gov/timeseries/WPSFD4

Core PPI http://data.bls.gov/timeseries/WPSFD49116 (wo food, energy, trade services)

The actual one month numbers (December over November) to 2-digit accuracy: PPI: +0.50%, Core PPI: +0.36%. When annualized, they are 6.0% and 4.4% respectively.

Below are the annualized numbers so they can be compared to the Fed's 2.0% target:

1 mo 3 mo 12 mo

6.0% 3.3% 3.0% PPI

4.4% 5.1% 3.5% CORE PPI = PPI ex Food, Energy, Trade Services

2.0% 2.0% 2.0% Fed Target

There is also a core PPI data series where core is defined as the PPI ex food and energy

http://data.bls.gov/timeseries/WPSFD49104

I use the one that is PPI ex food, energy, and trade services because that is the one the BLS highlights (and did so in the pre-Trump past too, so it's not a conniving Krasnov thing). Trade services, which is the wholesaler's margin, is very volatile from month to month.

THURSDAY JAN 29

# Unemployment insurance claims

Week ending Jan 24 -1,000 to 209,000, 205,000 expected, (Not seasonally adjusted: 231,181)

Continuing Claims, week ending Jan 17: -38k to 1.827M

https://apnews.com/article/unemployment-benefits-jobless-claims-layoffs-labor-21ccf4e6ebbcabbc424e2feb56f0fee7

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf . . . this release's permalink is at https://www.dol.gov/newsroom/releases/eta/eta20260129

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

# U.S. trade deficit (delayed report) NOVEMBER

US trade deficit widens by the most in nearly 34 years in November, Reuters, 1/29/28

https://finance.yahoo.com/news/us-trade-deficit-widens-most-144236696.html

* DU LBN THREAD (also of Reuters article) https://www.democraticunderground.com/10143607655

The trade gap increased 94.6% to $56.8 billion, the Commerce Department's Bureau of Economic Analysis and Census Bureau said on Thursday. The percentage change was the largest since March 1992. Economists polled by Reuters had forecast the trade deficit would rise to $40.5 billion.

MORE ---

The deterioration in the trade deficit in November could temper economists' expectations that trade will deliver another large boost to gross domestic product in the fourth quarter.

Trade contributed to GDP growth in the second and third quarters of 2025.

The Atlanta Federal Reserve is forecasting that GDP increased at a 5.4% annualized rate in the fourth quarter, though estimates from big Wall Street banks, including Goldman Sachs, are running well below a 3.0% pace.

* The U.S. trade deficit isn’t actually falling due to tariffs. It’s still near a record high, MarketWatch 1/29/26

https://www.marketwatch.com/story/fools-gold-the-u-s-trade-deficit-isnt-actually-falling-due-to-tariffs-its-still-near-a-record-high-17412f1b

In November, the deficit almost doubled to $56.8 billion from just $29.2 billion in October.

The October deficit was the lowest since 2009 and was almost entirely the result of disrupted trade patterns tied to higher U.S. tariffs imposed by the Trump administration.

More...

The U.S. trade deficit totaled $839.5 billion through the first 11 months of 2025, compared with $806.5 billion in the same period in 2024.

For all of 20215, the U.S. is on track to post the second- or third-largest trade deficit ever.

# U.S. productivity (revised) Q3 (was 4.9% in the initial report)

# Wholesale inventories (delayed report) NOVEMBER

# Factory orders (delayed report) NOVEMBER

WEDNESDAY JAN 28

# FOMC interest-rate decision and Powell press conference (2:00 P.M. and 2:30 P.M. ET respectively)

As expected, they kept the interest rate unchanged. There were 2 dissents, both wanting a rate reduction. I haven't looked or seen any jibber jabber about how many rate reductions are expected in 2026.

TUESDAY JAN 27

# Consumer confidence, Conference Board, January

Americans' confidence in the U.S. economy falls sharply in January to lowest level since 2014, AP, 1/27/26

https://finance.yahoo.com/news/americans-confidence-u-economy-falls-151544532.html

below even the lowest level of the pandemic

DU LBN Thread: https://www.democraticunderground.com/10143606137

From the source: https://www.conference-board.org/topics/consumer-confidence/

For graphs, click above link, or the DU LBN thread link

MONDAY JAN 26

# Durable-goods orders, NOVEMBER (delayed report)

Durable goods jump more than expected in November, 1/26/26

https://www.msn.com/en-us/money/markets/durable-goods-jump-more-than-expected-in-november/ar-AA1V0fWT

FRIDAY JAN 23

# Consumer sentiment (final) January

Consumer sentiment remains depressed in January as higher costs, weakening labor market weigh on outlook, Yahoo Finance, 1/23/26 https://finance.yahoo.com/news/consumer-sentiment-remains-depressed-in-january-as-higher-costs-weakening-labor-market-weigh-on-outlook-154756985.html

. . . The University of Michigan's Index of Consumer Sentiment for January came in at 56.4, up 3.5 points from December but some 21% below last year's level of 71.7. (the previous preliminary data number was 54)

. . . Inflation expectations showed some signs of improvement, with year-ahead inflation forecasts falling to 4% from 4.2%. (from another article: five to ten year inflation expectations inched up to 3.3% from 3.2% last month.)

. . . Bloomberg - consumer sentiment is at a 5-month high == https://www.msn.com/en-us/money/markets/us-consumer-sentiment-reaches-five-month-high-in-broad-gain/ar-AA1UPxug

. . . Progree - See 10 YEAR CHART - it barely caused the 3-month moving average to turn up just a bit, from a very low level

* SOURCE URL: https://www.sca.isr.umich.edu/

. . . 10 YEAR CHART: https://www.sca.isr.umich.edu/files/chicsr.pdf

# S&P flash U.S. services PMI January

# S&P flash U.S. manufacturing PMI January

Economy shows signs of cooling, S&P finds. Tariffs still weigh on growth and hiring, MarketWatch, 1/23/26

https://www.msn.com/en-us/money/markets/economy-shows-signs-of-cooling-s-p-finds-tariffs-still-weigh-on-growth-and-hiring/ar-AA1UPu58

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-cap-volatile-week-with-back-to-back-weekly-losses-210233078.html

A preliminary reading on S&P Global's US Manufacturing PMI showed the activity-tracking index hitting 51.9 in January. That was slightly below the 52 expected by economists tracked by Bloomberg, but a hair above the 51.8 print last month.

Meanwhile, the US Services PMI was 52.5 in January (so far), also short of the 52.9 projected but unchanged from the previous month. A reading above 50 signals growth, while those below reflect contraction.

Similarly, the Composite PMI, which combines the manufacturing and services surveys, hit 52.8 this month. That was higher than December's 52.7 but beneath economists' consensus estimate of 53. ((13 year graph of Composite PMI shown -progree))

The PMI, or Purchasing Managers’ Index, measures the health of the manufacturing or services sector based on surveys of business leaders. Overall, the readings showed business activity was relatively unchanged in January from the previous month.

THURSDAY JAN 22

# PCE inflation FOR NOVEMBER - the Fed's favorite inflation gauge. This is stale, considering that there are numbers out for both the December CPI and the December PPI (producer price index)

* LBN THREAD: Fed's main gauge shows inflation at 2.8% in November, edging further away from target, CNBC, 1/22/26 == https://www.democraticunderground.com/10143603115

* It was a combined October and November report. From a Yahoo article: "For portions of October lacking detailed information from the Consumer Price Index, which is used to calculate PCE, the BEA used an average of September and November figures."

* On a month-over-month basis, both November over October, and October over September came in at 0.2% -- that's true for both the headline number and the core number

* On a year-over-year basis, both the headline and the core numbers were 2.8%

* SOURCE URLS: 1/22/26 release: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-october-and-november-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-01/pi10-1125.pdf

. . . PCE DATA SERIES: https://fred.stlouisfed.org/series/PCEPI

. . . CORE PCE DATA SERIES: https://fred.stlouisfed.org/data/PCEPILFE

# GDP Q3 (first revision) - expected to be 4.3% annualized rate, same as the initial estimate. It turned out to be 4.4% annualized rate

https://finance.yahoo.com/news/consumer-spending-pushes-us-economy-133751928.html

. . . From the PCE article: “The strength of the consumption data adds further weight to the idea that the economy might not need additional policy support, with real consumption rising by 0.3% in both months,” noted Capital Economics economist Thomas Ryan.

# Personal spending and personal income for NOVEMBER -- see:

* SOURCE URLS: 1/22/26 release: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-october-and-november-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-01/pi10-1125.pdf

# Unemployment insurance claims

. . . US applications for jobless benefits inch up last week to a still-low 200,000 (( +1,000 to 200,000, 207k expected, week ending Jan 17 # Continuing Claims, week ending Jan 10: -26k to 1.85M ) AP, 1/22/26 == https://finance.yahoo.com/news/us-applications-jobless-benefits-inch-133912723.html

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf . . . this release's permalink is at https://www.dol.gov/newsroom/releases/eta/eta20260122

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

WEDNESDAY JAN 21

# Pending home sales US pending home sales plunge to five-month low in December, Reuters, 1/21/26

https://www.reuters.com/business/us-pending-home-sales-slump-five-month-low-december-2026-01-21/

Pending home sales index tumbles 9.3%, reverse gains notched since late summer

Spending on new single-family housing projects slumps 1.3% in October

TUESDAY JAN 20 - None scheduled

MONDAY JAN 19 - Martin Luther King Jr. Day, None scheduled

Friday Jan 16

# Industrial production and capacity utilization - US manufacturing output unexpectedly increases in December, Reuters, 1/16/26

https://finance.yahoo.com/news/us-december-industrial-production-rises-142129670.html

Thursday Jan 15

# Unemployment insurance claims

. Initial Unemployment Insurance Claims - Week Ending January 10: 198,000, down 9,000.

. . Note: Not Seasonally Adjusted: 330,684, Seasonally Adjusted: 198,000, quite a big seasonal adjustment

. Continuing Claims (week ending Jan 3): 1,884,000, down 19,000, 1/15/26

https://www.dol.gov/sites/dolgov/files/OPA/newsreleases/ui-claims/20260098.pdf

. Reuters - good article, they say the low seasonally adjusted initial claims level might be due to problem with seasonal adjustment. They also mention the NSA number above (330,684)

. . https://www.reuters.com/world/us/us-weekly-jobless-claims-unexpectedly-fall-amid-seasonal-adjustment-challenges-2026-01-15/

# Import prices

# Empire state and Philadelphia Fed's manufacturing surveys

Wednesday Jan 14

# Retail sales for November (delayed report) (KEEP IN MIND THESE ARE NOT INFLATION-ADJUSTED but they are seasonally adjusted)

Numbers are the increase over the previous month unless specified otherwise e.g. "12 months" which is the 12 month average aka year-over-year

Retail sales rose a better-than-expected 0.6% in November, and rose 3.3% in the past 12 months through November (while inflation thru November was 2.7%, so retail sales gained only 0.6% over the 12 months in inflation-adjusted dollars), AP, 1/14/26 == https://finance.yahoo.com/news/retail-sales-rose-better-expected-134204407.html

(The previous 2 months were pathetic: September was +0.1% (while inflation was +0.3%), October was -0.1% (there are no month-to-month inflation numbers for October or November; again all of these are seasonally adjusted numbers, but not inflation-adjusted),

The MahatmaKaneJeeves LBN Thread: Wholesale inflation was softer than expected, RETAIL SALES moved higher in November, 1/14/26 == https://www.democraticunderground.com/10143598490

. . . [] From the Source: https://www.census.gov/retail/index.html -> https://www.census.gov/retail/sales.html :

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USN), Not Seasonally Adjusted: -0.8% == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USN

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USS), Seasonally Adjusted: +0.6% (September was +0.1%, October was -0.1%, ) == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USS

. Very strange that in November, the seasonal adjustment process revised the November over October upward from -0.8% to +0.6%. October over September got seaonally revised downward from +4.9% to -0.1%

# PPI (Producer Price Index, aka Wholesale Prices) for November (delayed report)

Numbers are the increase over the previous month unless specified otherwise like "12 months" which is the 12 month average aka year-over-year

PPI for November +0.2% (Oct was +0.1%), 12 months: +3.0%

CORE PPI excluding food, energy and trade services: +0.2% (was +0.7% in October) 12 months: +3.5%, 1/14/26

Note that in November, for both the PPI and Core PPI, the 0.2% increase, when annualized is 2.4%, which exceeds the Fed's 2.0% target. And the year-over-year numbers (PPI: +3.0%, Core PPI: +3.5%) are well over the Fed's 2.0% target

. MahatmaKaneJeeves LBN Thread: Wholesale inflation was softer than expected, retail sales moved higher in November, 1/14/26 == https://www.democraticunderground.com/10143598490

. Ultimate Source: https://www.bls.gov/news.release/ppi.nr0.htm

# Existing home sales (delayed report)

Tuesday Jan 13

# CPI Consumer Price Index - The headline (all items) number was as expected: December (over November): +0.3%, Year-over-year: +2.7%

The Core measure (which excludes food and energy) was a 0.1 percentage points below expectations: December (over November): +0.2%, Year-over-year: 2.6%. Note that the one-month numbers when annualized (3.6% and 2.4%) are over the Fed's 2.0% target, as are both year-over-year numbers.

The actual numbers calculated from the index values for more accuracy:

All items CPI: December (over November): +0.307% (which annualizes to 3.75%),

Core CPI: December (over November): +0.239% (which annualizes to 2.91%),

LBN thread: https://www.democraticunderground.com/10143597741

# New home sales

# Budget deficit

# NFIB optimism index

Monday Jan 12

# Nothing

FRIDAY, JANUARY 9

# Big BLS jobs report : +50,000 non-farm payroll jobs, unemployment rate ticked down from 4.5% to 4.4%. A LOT more to this story, for example, thanks to downward revisions of October and November, there are actually 26k fewer non-farm payroll jobs than were reported in the previous (December 16) report. AND , didya know, in December actual (meaning not-seasonally adjusted) jobs fell by 192,000, but seasonal adjustment turned that to a positive 50,000? Could YOU use a seasonal adjustment like that? AND, President literal asswipe posted several jobs numbers 12 hours before the 8:30 AM ET release time (did you know that they show the president and the entire Council of Economic Advisers the jobs report the evening before it is released?). AND there is probably a couple other things to say, I'll have to review the thread...

the LBN thread link, full of information, is https://www.democraticunderground.com/10143595598

# Consumer Sentiment - a slight improvement but graph still looks awful

https://www.sca.isr.umich.edu/

GRAPH: https://www.sca.isr.umich.edu/files/chicsr.pdf

THURSDAY JANUARY 8

# Unemployment insurance claims: 208,000, an 8,000 increase over last week

# Q3 Productivity - I haven't looked at it, but from a headline I saw, it's a big jump thanks to the 4.3% Q3 GDP (annualized rate) reported in December,

WEDNESDAY, JANUARY 7

# ADP private payroll employment, +41,000 PRIVATE payroll jobs (by the way, in comparison the BLS jobs report that came out Friday 1/9, with the headline +50,000 jobs number, had a private payroll jobs increase of +37,000, a very unusally close match to the ADP number). (ADP has payroll data for about 20% of the private work force, and somehow they estimate the other 80%)

https://www.democraticunderground.com/10143594195

https://adpemploymentreport.com/

# ISM Services,

# JOLTS Job Openings and Labor Turnover Survey, - kinda bad report. lowest job openings in over a year for one thing. The number of job openings fell in November, while the hiring rate was a paltry 3.2%. There were 1.1 unemployed people for every available job, the highest level since early 2021. https://finance.yahoo.com/news/layoff-plans-for-december-hit-lowest-monthly-level-since-2024-in-positive-sign-challenger-says-131808125.html (the article is almost all about the Challenger, Gray, and Christmas report, but the above blurb is in reference to the JOLTS report)

TUESDAY, JANUARY 6

* S&P Services PMI -- shows sector grew at slowest pace in 8 months in December

https://finance.yahoo.com/news/live/stock-market-today-dow-crosses-49000-sp-500-jumps-to-new-high-in-record-setting-start-to-year-194907643.html

(and scroll down that page)

MONDAY, JANUARY 5

* ISM Manufacturing -- US Factory Malaise Continues as Gauge Drops to One-Year Low, Bloomberg 1/5/26

https://finance.yahoo.com/news/us-factory-malaise-continues-gauge-152835595.html

head count shrinks for 11th straight month. (weren't tariffs supposed to fix that?)

FRIDAY, JANUARY 2

* S&P Manufacturing - I haven't seen the report

WEDNESDAY DECEMBER 31

* Weekly unemployment insurance claims, 199,000. It was 214,000 in last week's report

https://www.dol.gov/sites/dolgov/files/OPA/newsreleases/ui-claims/20251646.pdf

TUESDAY DECEMBER 30

* Case-Shiller home prices index - I saw a headline: home prices up for a 3rd straight month, and up 1.4% since October 2024

MONDAY DECEMBER 29

* Pending home sales - I saw a headline: up 3.35% from November and up 2.6% year-over-year (non-govt, National Association of Realtors)

WEDNESDAY DECEMBER 24

* Weekly unemployment insurance claims - 224,000 was reported December 18. 214,000 was reported today, December 24, a drop of 10,000 . But continuing claims rose by 38,000 to 1.92 million (govt)

TUESDAY DECEMBER 23

* GDP Q3 first estimate (delayed report, normally released late September). (govt) -- it came in at a 4.3% annualized rate, well above the 3.3% rate economists were expecting. Various factors cited in media: an acceleration of EV purchases prior to the Sept 30 expiration of tax credits. A lot of spending by big tech companies on AI (investment spending boosts the GDP number). A substantial rise in exports (up 8.8% annualized rate) and a small drop in imports -- both these boost the GDP number, Federal spending also played a sizable role, a reflection of the large uptick in defense spending as well as buyouts for federal workers. Also, it reflects the "K-shaped" economy -- higher-income people flush with growing stock market wealth increased their spending, while lesser-income people struggled with higher prices and a weakening job market.

LBN thread: https://www.democraticunderground.com/10143587157 ## From the source: https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

* Consumer Confidence (Conference Board, non-govt) - result: the 5th straight month of decline. The worst since April, and at about the same level as seen in the 2020 pandemic year. Except there is no microbe-driven pandemic, it's all Trumpdemic now. Consumers’ assessments of their current economic situation tumbled 9.5 points to 116.8.

LBN thread (see graph in reply #2) https://www.democraticunderground.com/10143587258

* Durable goods orders - I haven't looked at yet

* Industrial production and capacity utilization - I haven't looked at yet

FRIDAY DECEMBER 19

* Existing home sales (non-govt) - I haven't looked at yet

* Consumer Sentiment final (non-govt) - here's an article:

https://finance.yahoo.com/news/consumer-sentiment-shows-substantial-decline-from-last-year-amid-higher-prices-tough-job-market-160618145.html

THUR DECEMBER 18:

* Weekly unemployment insurance claims for the week ending Dec 13 (it was 236,000 for the week ending Dec 6) - In the week ending December 13, the advance figure for seasonally adjusted initial claims was 224,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 236,000 to 237,000. (govt)

* Consumer price index for November (govt) (note: the one for October was cancelled. The November one was originally scheduled for December 10 before the Fed's rate-setting meeting, but alas was delayed until 8 days after the meeting) - result: 2.7% year-over-year, a cooling from the 3.0% year-over-year reported in the September report, and a 0.2% increase over the last 2 months. LBN thread: https://www.democraticunderground.com/10143584377

TUE DECEMBER 16:

* The long-delayed big Jobs report (featuring the headline non-farm payroll jobs and unemployment rate) (govt). Expected: +50,000 jobs in November and 4.5% unemployment rate. Actual: -105,000 in October and +64,000 in November for a net drop of jobs over these 2 months of 41,000. Nonfarm payroll jobs averaged only 17k/month over the last 7 months and 22k over the last 3 months. These are seasonally adjusted numbers. The raw numbers (i.e. not seasonally adjusted numbers) are 204k/month and 416k/month respectively. And the unemployment rate is 4.6% in November, up from 4.4% in September. LBN thread: https://www.democraticunderground.com/10143583215

There was not, and never will be a separate October jobs report. The payroll stuff Establishment survey was taken and will be included in the November report (as it was in the Decmber 16 report). The household survey that produces the unemployment rate was not done in October, and so the October unemployment rate will be a blank in the records forever.

More details: https://www.democraticunderground.com/10143583215#post19

The LBN thread: https://www.democraticunderground.com/10143583215 .

Please disregard all the comments about "Christmas hires" and "seasonal hires" - those have been adjusted for.

TUE DECEMBER 16 Continued:

There's another jobs report that came out -- the ADP report on PRIVATE sector payrolls:

16,250 private jobs/week for 4 weeks ending 11/29/25 (so roughly +65,000 private sector jobs in the month of November)

LBN thread: https://www.democraticunderground.com/10143583228

Again, ignore the comment about seasonal hiring. The ADP reports seasonally adjusted numbers

Also realize that The ADP numbers cover only about 20% of the nation's private workforce. They have to estimate the other 80%.

https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3506135

The retail sales report that came out December 16: Sept: +0.1% and October: +0.0%. Those are nominal dollar increases. After adjusting for inflation, which was 0.3% month-over-month in September, and an unknown amount in October, those are declines of real spending of 0.2% and 0.3%, assuming that October also comes in at 0.3% month-over-month inflation. Yes, they are seasonally adjusted.

https://www.msn.com/en-us/money/markets/retail-sales-flat-in-october-as-uncertainty-tempers-consumer-spending/ar-AA1SsP9b

S&P flash U.S. services and manufacturing PMI's (non-govt) - I haven't looked at this yet

=================================================================

General Comments

Please don't believe the fabrication that Fed Chair Powell said, or implied, that the jobs numbers are "fudged". He did not. The person posting that claim included no excerpt that one can read to judge what exactly he said, and that was deliberate. When confronted, that person expressed some other reasons (again without supporting information) for believing the numbers are fudged. That may be so, But that does not excuse very deliberately misleading one's fellow progressives about what Powell said.

Please don't believe reports that 1 million or 1.1 million jobs were lost in 2025 so far, implying these are net job losses (jobs lost minus jobs gained). This is based on Challenger, Gray, and Christmas that reported 1,170,821 job cuts were ANNOUNCED. And they are just layoff announcements, and they are not net of hiring announcements or any actual hiring. As the monthly JOLTS (Job Openings and Labor Turnover Survey) shows, there are a lot of layoffs (and voluntary leavings of jobs) and a lot of hiring every month. The excuse that media misreports the Challenger report too is not an excuse for deliberately misleading one's fellow progressives, after being presented with the information about what the Challenger etc. report actually said.

The media mis-reports a lot of things like Hillary's email and Hunter Biden's laptop with cherry-picked misleading factoids, but that is never an excuse for echoing those reports here after being made aware of the factual record.

There's another myth that's spreading: that the new head of the BLS (Bureau of Labor Statistics) is a Trump appointee, E.J. Antoni. However, his nomination was withdrawn due to too many controversies.

The current head is Acting Commissioner, William J. Wiatrowski, who has served in this role twice previously, the first time from January 2017 to March 2019, and the second time from March 2023 to January 2024

https://en.wikipedia.org/wiki/Bureau_of_Labor_Statistics

Global Stocks Trounce the S&P 500 in Trump’s Chaotic First Year, Bloomberg, 1/20/26

https://finance.yahoo.com/news/global-stocks-trounce-p-500-131530108.html

Trump’s comparison with his predecessors is no better: As far as the S&P 500 goes, the first-year gain under Trump clocks in as only the ninth best start to a term since World War II, according to CFRA. Ronald Reagan, George H.W. Bush, Bill Clinton, Barack Obama, Joe Biden — and even Trump during his first stint — all saw bigger gains.

US presidents, of course, don’t determine the direction of the stock market, as much as they take the blame or credit. But in Trump’s case, his trade war, foreign-policy surprises like pushing for a US takeover of Greenland, moves to exert greater control over key industries, and threat to the Federal Reserve’s independence have all periodically unnerved investors. That, in turn, has effectively tapped the brakes on a rally driven largely by the artificial-intelligence boom and the surprisingly resilient economy he inherited.

-snip-

[Also] MSCI’s emerging-market index rose over 30% last year, it’s biggest advance since 2017.

The S&P 500 gained 15.7% in Trump's first year, according to a table in the article, comparing the first year of all presidential terms since (and including) FDR.

US stocks are off to their worst start versus the global market since 1995, Yahoo Finance, 2/18/26

https://finance.yahoo.com/news/us-stocks-are-off-to-their-worst-start-versus-the-global-market-since-1995-110019152.html

*THERE's an iShares MSCI ACWI ex U.S. ETF (ACWX) VERSUS S&P 500 - where one can set 1 D, 5D, 1M, 6M, YTD (9.7% v. 0.8%), 1Y (31.7% vs. 12.9%), 5Y (30.0% v. 76.7%), ALL (starting about 4/2008: 35% vs. 393%)

(ACWI stands for All Country World Index). One can see that the S&P 500 vastly outperformed the rest of the world in the past 5 years and the past 18 years, but since late 2024, the rest of the world has outperformed the S&P 500.

And in an environment where geopolitical risk increasingly comes from inside the US — whether from the Trump administration's tariff regime, comments about an annexation of Greenland, or other moves — investor attention has turned toward the rest of the world.

...US stocks just keep getting more expensive. ... through the last 10 years, as Big Tech's explosion has driven valuations sky high, US price-to-earnings ratios are now an average of 40% higher than those throughout the rest of the world market.

The US stock market has also become heavily concentrated in the tech sector.

As of December, the top 10 largest companies in the US — the "Magnificent Seven" Big Tech stocks, plus Broadcom (AVGO), Eli Lilly (LLY), and Visa (V) — accounted for 40% of S&P 500 holdings, according to data from the investment brokerage Lord Abbett, far above the roughly 20% weight of the top 10 holdings a decade ago.

"The US market trades above a 20x P/E — even excluding the 'Magnificent 7,'" Goldman Sachs strategists wrote in a recent client note. "This is unusually high."

progree

(12,860 posts)See OP for the statistics.

progree

(12,860 posts)See OP for details

progree

(12,860 posts)see OP for details.

progree

(12,860 posts)Details in OP.

progree

(12,860 posts)See OP for details, and a graph of the DOW.

progree

(12,860 posts)Details in the OP.

progree

(12,860 posts)Details in the OP.

progree

(12,860 posts)Details in OP.

progree

(12,860 posts)Details in OP.

progree

(12,860 posts)Details in OP. ATH is All Time High. I don't kick this every market day, but it's been several days, and it's gotten well down on the listings, so I decided to kick it. It looks like the Trump slump since election day is about at an end, only 0.1% down since election day, and with 3 straight market days of gains. Since inauguration day, its down 3.7%.

progree

(12,860 posts)ATH is All Time High. Details in OP including more comparisons like down 5.4% since pre-inauguration day, and down 3.6% year-to-date.

I don't kick this every market day, but it's been several days, and it's gotten well down on the listings, so I decided to kick it. Note this closing is moments before the announcement of "Liberation Day" tariffs, so it's a good benchmark to compare to what follows in the next few days.

Arizona78

(8 posts)Trump’s bill could soon trigger a repo market crisis and push America and much of the world—toward bankruptcy. Something massive is on the horizon. Get ready.

Paul Krugman is deeply concerned about the uncontrolled rise in debt, which could sharply push up interest rates leading to bankruptcy.

https://paulkrugman.substack.com/p/trumps-big-beautiful-debt-bomb

Hugin

(37,710 posts)I look at it often. ![]()

progree

(12,860 posts)Hugin

(37,710 posts)Crypto has taken over the last week or so. BTC $120K to ~ $97K.

progree

(12,860 posts)I'm seeing that proclaimed in a couple of articles in the yahoo.finance.com page today.

It's all-time high in October was over $126,000. Right now as I post this, it's 96,277, down 23.6%

I've been reporting Bitcoin near the top of my OP each time I update anything, along with the 10-year Treasury yield. I'm not sure why, but a lot of people are interested in it. Actually, it's kind of against my "religion", given the amount of electricity and water that bitcoin "miners" consume. I read recently that just ONE Bitcoin transaction uses as much electricity as does the average U.S. household over 38 days (more than a month!)

I might buy the Bitcoin evangelists' argument that bitcoin's high value (still) is that they keep the bitcoin supply very limited. But there are all kinds of new cryptocurrencies being created and eventually the amount of money available from people willing to support this ever-expanding ocean of speculative crypto-investments will reach a peak. (And besides, rarity doesn't guarantee high value).

Hugin

(37,710 posts)If I had a nickel for every time I’d said that. ![]()

I am far from liking anything about crypto. I try to avoid things that are easy to buy and difficult to sell. I do monitor it, tho. Due to its position in the techbro’s DOW -> AI -> Crypto financial ouroboros.

progree

(12,860 posts)With this Friday's update (actually posted Sunday 2/15), I've added to the calendar of reports (the "calendar" is a list of past economic reports with most results summarized as well as scheduled future ones)

# NFIB optimism index - small business confidence slipped

# US consumer delinquencies jump to highest in almost a decade

# Employment Cost index, Q4 - Considered the best statistic on wages/salaries and benefits

# Import price index

# Retail sales (seasonally adjusted) in December did not keep up with inflation, meaning consumers bought less stuff when adjusted for prices

# The big "First Friday" BLS jobs report that was ballyhoo'd as a big surge of jobs in January (a historically pale +130k, but since it was better than the horrible months before, the media decided it was a "surge" ). And 2024 and 2025 were revised down by a combined nearly million jobs in their annual revision, leaving only 181,000 net new jobs in all of 2025 which averages to only 15k/month.

# Unemployment insurance claims - fell by 5,000, but continuing claims up by 21,000

# Existing home prices -- Realtors report a ‘new housing crisis’ as January home sales tank more than 8%

# CPI Consumer price index - the media ballyhoo'd it as a softening of inflation, but the 3-month rolling average rose for the 2nd month in a row. The Chicago Federal Reserve's Goolsbee points out that worrisomely service inflation is persistent and little affected by what happens with tariffs either way (IOW if tariffs are softened and/or the impact of tariffs was a "one off" one-time event, inflation will still be a problem), and that inflation has been above the Fed's target for more than 4 1/2 years now..

(The summaries in the "Calendar" section of the OP are for the most part longer, than what I've shown above, and with links).

I've also added the coming week's reports, many with links to the source data

As usual, I provide a summary of each day's stock market / economic activity, including the "Scrolling down the page" (Yahoo Finance's "Stock Market Today" page) for articles of interest.

All this takes me at least 7 hours a week. This is bordering on unsustainable, but I find the "Calendar" collection of reports and source links and LBN and other DU threads' links a very useful reference.

Some of these are non-government reports, so they can be somewhat broadly compared to the picture that the federal reports are painting. E.g. the ADP private payrolls report (ADP is a private processor about 20% of the U.S. private payroll, and they estimate the other 80%), and the Challenger, Gray and Christmas reports. The consumer confidence and consumer sentiment reports (separate reports from separate non-government organizations) are also of interest, as are existing housing sales.